Opay Alternatives: Top 10 Apps Similar To Opay

List of Top 10 Apps Similar To Opay for Online Banking, Online Payments, Online Savings Account and Virtual Debit Cards

Opay is one of the best and at the same time one of the most popular Fintech companies in Nigeria today. Even due to the recent cashless policy in Nigeria, that is when I decided to open an account with Opay likewise many people around me. I say this just to let you know how popular the company is. Opay and other Fintech companies have saved many during the recent financial strike in the country. Without much Ado, read on to see the analyzed list of the top 10 apps similar to Opay.

Why Fintech Companies Are So Popular In Nigeria Today

Do you know why Fintech companies are so popular in Nigeria today?

If not, kindly see the following reasons below:

Large Unbanked Population

According to the World Bank, over 60% of Nigeria’s population is unbanked, meaning they do not have access to formal banking services.

Fintech companies like Opay and the top 10 apps similar to Opay are filling this gap by providing digital financial services that are accessible and affordable to the unbanked population.

Mobile Phone Penetration

Nigeria has one of the highest mobile phone penetration rates in the world, with over 100 million internet users.

This presents a greater opportunity for fintech companies to offer mobile based financial services, such as mobile payments, money transfers, loans, utility bills payment, incentives, and a lot more.

Government Support

Another reason why Fintech companies are so popular in Nigeria today is that the Nigerian government has been supportive of fintech innovation and has implemented policies and regulations that encourage the growth of the industry.

For instance, the Central Bank of Nigeria (CBN) has launched various initiatives to promote financial inclusion and support fintech startups.

Increasing Investor Interest

Also, fintech companies in Nigeria have attracted significant investment in recent years, with both local and international investors seeing the potential for growth in the industry.

This has actually led to the emergence of a vibrant startup ecosystem and an increasing number of innovative fintech solutions in the country.

Changing consumer behavior

Consumer behavior in Nigeria is changing, with more people embracing digital technology and mobile based solutions.

This has created a growing demand for fintech services, which are seen as more convenient, accessible, and affordable than traditional banking services.

Opportunity For Financial Innovation

Fintech companies in Nigeria are also leveraging technology to provide innovative financial services that cater to the unique needs of the Nigerian market.

This includes solutions such as peer-to-peer lending, digital savings, and insurance products that are tailored to the specific needs of consumers and small businesses in Nigeria.

List of Top 10 Apps Similar To Opay

The top 10 Apps Similar to Opay are the following:

1. Paystack

Paystack is a Nigerian online payment and Fintech company founded by a Man named Shola Akinlade and Ezra Olubi in 2015.

Paystack fintech company allows individual businesses to accept payments via multiple channels, this includes debit/credit cards, bank transfers, and mobile money.

It is currently one of the top 10 apps similar to Opay which has been performing in the country and is experiencing significant growth.

2. Flutterwave

Flutterwave is a Nigerian fintech company which was founded by Iyinoluwa Aboyeji and Agboola in the year 2016.

The Fintech company offers a suite of payment and financial services which enable businesses to accept payments from customers in more than 150 countries.

3. Paga

Paga is also an online mobile payment service in Nigeria which was established by Tayo Oviosu in 2009.

It allows users to send and receive money, pay bills, and buy airtime and data from their mobile phones.

The company also has POS agents through which people can send and receive money all across the 36 states IN Nigeria.

4. Carbon

Carbon was formerly known as Paylater, it is a Nigerian digital lender which was founded by Chijioke Dozie and Ngozi Dozie in the year 2016.

With this company, you can get a loan of up to millions of naira to finance your business and also provide other kinds of financial services to individuals in the country.

For you to apply for a loan from this company, you must meet their requirements.

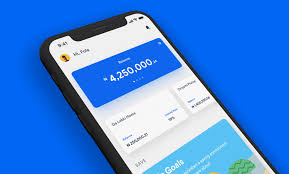

5. Kuda

Is yet another Fintech company in Nigeria included in the list of top 10 apps similar to Opay, it is a Nigerian digital bank founded by Babs Ogundeyi and Musty Mustapha in 2018.

It offers free banking services, including account opening, transfers, and bill payments, via a mobile app.

Also Read: How to get a reversal for a failed POS or ATM transaction (All Nigerian banks)

Today, the bank has become popular among young and adult Nigerians, especially those who are tech-savvy and value convenience.

Kuda bank app is available for download on both Android and iOS devices, and customers can use it to open an account, deposit money, and make transactions.

6. Branch

Branch is yet another popular Nigerian fintech company with a primary focus on lending loans to individuals followed by other services, this digital lending platform was founded by Matt Flannery and Daniel Jung in 2015.

It provides loans and other financial services to individuals and businesses in emerging markets.

7. Renmoney

Renmoney is a Nigerian fintech company founded by Oluwatobi Boshoro in 2012.

Read: Kuda vs Opay: which is better? Fees, user feedback, features and trust in 2023

It offers loans, savings, and other financial services to individuals and small businesses and remains one of the top 10 apps similar to Opay fintech company in Nigeria.

Renmoney focuses on providing different kinds of loans in which one of which is a personal loan.

Today, the company has millions of active downloads and thousands of positive feedback on its services.

8. Cowrywise

Cowrywise is one of my favorite fintech companies in Nigeria. This company specialized in savings and Investments.

The company was founded by Razaq Ahmed and Edward Popoola in the year 2017.

Cowrywise allows users to save and invest their money in different asset classes, such as stocks, bonds, and mutual funds.

One of the advantages of using cowrywise is the ability to save and lock your money for a certain period of time, during the time the money is locked on Cowrywise, users will not be able to withdraw the money until the maturity period.

9. QuickCheck

Quickcheck is my first ever tested and trusted fintech company in Nigeria.

I personally made use of this platform in 2020 and could tell their services are superb.

This company is a Nigerian digital lender founded by Fabiano Di Tomaso and Oluwatosin Oluwole in 2016.

It provides instant loans to individuals and small businesses using its proprietary credit scoring algorithm without the need for collateral or any paperwork.

I can boldly say this is one of the top 10 similar apps to Opay their financial services are superb.

10. PiggyVest

PiggyVest (formerly Piggybank) is a Nigerian savings and investment platform founded by Odunayo Eweniyi, Joshua Chibueze, and Somto Ifezue in 2016.

May Like: Best Loan Applications in Nigeria 2023

It allows users to save and invest their money in different products, such as savings plans, mutual funds, and insurance just like Cowrywise.

Frequently Asked Questions (FAQs) On The Top 10 apps similar to Opay

Which app is similar to Opay?

There are several apps that are similar to Opay, depending on which specific services or features you are looking for. Here are a few options:

- PalmPay: This is a mobile payment platform that offers similar services to Opay, including bill payments, airtime recharge, and peer-to-peer money transfers. It is available in Nigeria and Ghana.

- Paystack: This is a payment gateway that allows businesses to accept payments online through various channels, including cards, bank transfers, and mobile money. It is available in several African countries, including Nigeria, Ghana, and South Africa.

- Flutterwave: This is another payment gateway that allows businesses to accept payments online. It supports various payment methods, including cards, bank transfers, and mobile money, and is available in several African countries.

- Carbon: This is a financial services platform that offers a range of services, including loans, investments, and bill payments. It is available in Nigeria and Kenya.

- Kuda: This is a digital bank that offers various banking services, including account opening, money transfers, and bill payments. It is available in Nigeria.

These are just a few examples, and there are many other apps that offer similar services to Opay. It’s best to research and compare different options to find the one that best fits your needs.

What services do apps similar to Opay offer?

Apps similar to Opay typically offer a range of financial services, including mobile payments, money transfers, bill payments, loans, savings, and investment products.

Are these apps available in multiple countries?

Many of these apps are available in multiple countries, with a focus on emerging markets in Africa and other parts of the world.

How do these apps differ from traditional banking services?

Apps similar to Opay typically offer more convenience, accessibility, and affordability than traditional banking services.

They often use digital technology to reduce costs and provide faster, more efficient services.

Are these apps secure?

These apps typically use encryption and other security measures to protect users’ financial data and transactions.

However, it’s important users should always take precautions to protect their personal and financial information, such as using strong passwords and avoiding public Wi-Fi networks when making transactions.

How do I download and use these apps?

You can download these apps from the Google Play Store or Apple App Store, depending on your device. Once you have downloaded the app, you will typically need to sign up and create an account. The app will then guide you through the process of using its various features and services.