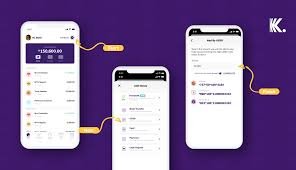

MoniePoint Registration: How To Open MoniePoint Account, How To Make Payment (Send and Receive Money) with Moniepoint App

This post is a guide to show you how to open a MoniePoint account, how to make payments on MoniePoint, how to send money with MoniePoint app likewise how to receive money with MoniePoint app in Nigeria.

If you are interested in opening a MoniePoint account, you’re likely to find it difficult to successfully create an account and after you have already signed up successfully, transacting using the app might seem difficult and for this reason, I’ve decided to make a write up on make payments on MoniePoint, how to send money with MoniePoint app likewise how to receive money with MoniePoint app in Nigeria.

As a new user, I would like you to see the introduction to exactly what MoniePoint is and the many things you ought to have known about it before using the app.

Let’s dive in now!

What is MoniePoint?

MoniePoint is a Nigerian-based financial technology company that provides digital financial services to individuals and businesses.

The company’s primary focus is on facilitating transactions between customers and merchants by providing a network of agents who serve as intermediaries.

MoniePoint’s services include cash transfers, bill payments, airtime recharge, and mobile banking. The company is known for its extensive agent network, which covers over 20,000 locations across Nigeria.

MoniePoint is committed to promoting financial inclusion by providing easy and affordable access to financial services for everyone, including those in rural areas. The company also uses cutting-edge technology to ensure that its services are secure and reliable.

What you can do with MoniePoint? – Financial Services Offered by MoniePoint

With MoniePoint, you can perform a wide range of digital financial transactions, such as those shared below:

Cash transfers

As a successfully registered user, you’re endowed with the opportunity to send money to any bank account or mobile wallet in Nigeria instantly.

Bill payments

You can also pay for utility bills such as electricity, water, and cable TV subscriptions conveniently like other digital banks in Nigeria.

Airtime recharge

You don’t necessarily need to go around to buy a recharge card. You can recharge your mobile phone or buy airtime for others on any network in Nigeria right from your smartphone phone on MoniePoint.

Mobile banking

Most importantly, as a user, you can check your account balance, pay bills, and transfer funds using MoniePoint’s mobile app.

Agent banking

You can access banking services such as account opening, cash deposit, and withdrawal at any of MoniePoint’s agent locations.

Related: How To Become MoniePoint Aggregator And MoniePoint Agent

In addition, MoniePoint offers other value added services such as loan disbursement, savings, and investment opportunities.

MoniePoint’s services are accessible via its website, mobile app, or any of its agent locations.

MoniePoint Registration: How to Create MoniePoint Account Easily

If you are not already a registered user, kindly follow the guidelines on how to open a MoniePoint account easily that I’ve provided right below now:

- Download the MoniePoint mobile app from the Google Play Store or Apple App Store.

- Launch the app and click on the “Sign Up” button.

- Fill in your personal details, such as your name, phone number, and email address.

- Create a strong password and confirm it.

- Accept the terms and conditions of MoniePoint.

- Verify your phone number by entering the six-digit code sent to your phone.

- Enter your BVN (Bank Verification Number) to complete your account registration.

Just immediately after your BVN has been verified, your account will be activated, and you can start using MoniePoint’s services.

An alternative way how to open a MoniePoint account is to visit any of MoniePoint’s agent locations and provide them with your personal details and BVN to open an account.

You will receive a welcome message containing your account details and instructions on how to use MoniePoint’s services.

How to make payments on MoniePoint

For you to successfully make payments on MoniePoint, kindly follow these steps:

- Open the MoniePoint mobile app and log in to your account.

- Click on “Payments” on the bottom menu of the app.

- Choose the type of payment you want to make, such as bill payment, transfer, or airtime purchase.

- If you’re making a transfer, enter the recipient’s bank details or select a saved contact.

- Enter the amount you want to pay or transfer.

- If making a bill payment, select the biller from the list of billers or enter the biller’s details.

- If making an airtime purchase, select the mobile network and enter the phone number.

- Review the payment details to ensure they’re correct.

- Enter your normal 4-digit PIN to confirm the payment.

How to send money on MoniePoint App

You’ve learned how to open a MoniePoint account, now let’s see how to send money on MoniePoint, ensure you follow these steps:

- Open the MoniePoint mobile app and log in to your account.

- Tap on “Payments” on the bottom menu of the app.

- Tap on “Transfer” to start a transfer.

- Choose the account you want to transfer money from, if you have multiple accounts.

- Enter the recipient’s bank details, including the bank name, account number, and account name.

- Enter the amount you want to transfer.

- Please make you review the details to ensure they’re correct.

- Enter your 4-digit PIN to confirm the transfer.

How to receive money on MoniePoint App

If you also want to learn how to receive money on MoniePoint in Nigeria, kindly follow the process below:

Ask the person sending you money to provide their bank details, including their account name, bank name, and account number.

- Open the MoniePoint mobile app and log in to your account.

- Click on “Payments” on the bottom menu of the app.

- Click on “Receive” to start receiving money.

- Enter the amount of money you’re receiving.

- Enter the sender’s bank details, including the account name, bank name, and account number.

- Review the details to ensure they’re correct before you continue with the transaction.

- Enter your 4-digit PIN to confirm the transaction.

Related: How To Close Or Deactivate MoniePoint Account Without Stress

Your money will be credited to your Kuda bank account immediately.

How can I close my MoniePoint Account?

If you are already a registered user and felt there’s a need to close your MoniePoint account you will need to contact MoniePoint customer support.

You can reach MoniePoint customer support via email at support@moniepoint.com or by phone at +234 1 700 7777.

You will need to provide your account details and a reason for closing your account.

It’s worth noting that MoniePoint does not provide an option to close an account via its mobile app or website.

Therefore, you will need to contact customer support to initiate the account closure process.

Additionally, before closing your account, ensure that you withdraw all funds and cancel any pending transactions. MoniePoint may also require you to provide valid identification documents to confirm your identity and process the account closure.

Frequently Asked Questions On how to Open MoniePoint Account

Here are some frequently asked questions about how to open a MoniePoint account:

Do I need to visit a bank to open a MoniePoint account?

No, you can open a MoniePoint account online by downloading the mobile app and registering your details.

What documents do I need to open a MoniePoint account?

You will need your Bank Verification Number (BVN) to open a MoniePoint account.

You may also need to provide valid identification documents to confirm your identity.

Is there a fee to open a MoniePoint account?

No, opening a MoniePoint account is free.

How long does it take to open a MoniePoint account?

It takes only a few minutes to complete the registration process and open a MoniePoint account.

Can I open a MoniePoint account if I am not a Nigerian citizen?

No, MoniePoint is currently only available to Nigerian citizens with a valid BVN.

Can I open multiple MoniePoint accounts with the same BVN?

No, you can only open one MoniePoint account per BVN.

Can I open a MoniePoint account without a smartphone?

No, you need a smartphone and internet connection to download the MoniePoint app and register for an account.

What should I do if I encounter any issues while opening a MoniePoint account?

If you encounter any issues while opening a MoniePoint account, you can contact MoniePoint customer support via email or phone for assistance.