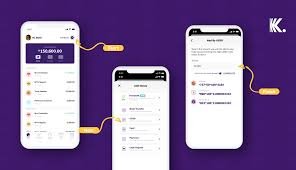

Kuda vs Opay: which is better? Fees, user feedback, features and trust in 2023

Online banking in Nigeria is currently on an uptrend, while this is not a completely new thing, many nigerians are yet to experience this digital finance evolution.

Kuda micro finance bank and opay technologies are two organizations that have revolutionize the fin-tech space and have a big influence on how financial services are carried out in the country. Despite a plethora of other competing corporations, they have really held their ground well.

Being two of the most used online banking applications, it’s no surprise that users may be divided on which to use.

That’s exactly why I brought the kuda vs opay analysis post here, after making my research I’ve been able to come up with the below comparison.

kuda vs opay comparison

Kuda and opay statistics

Kuda:

- Downoads: 8 Million +

- Combine reviews android and iOS: over 234,000

- Combined average Ratings: 4.6

- According to techcrunch kuda is valued at over $500M

Opay:

- Downoads: 11 Million +

- Combine reviews android and iOS: over 246,000

- Combined average Ratings: 4.3

- According to techcrunch opay is Africa fastest growing unicorn and its valued at over $2bn

Accessibility

When it comes to Accessibility, both opay and kuda are almost identical. Opay and kuda delivers good speed of use, They’re both fast when it comes to launch time, transfer speed is very okay as well and almost all the transactions will deliver unless you’re having network issues at your side.

There’s still occasional network issues on both applications, issues like system busy have become prevalent in the opay application of late, I hope opay looks into this as soon as possible.

Features & Functionalities

When it comes to features I give it to opay, Opay app is one of the best, if not the best microfinance and mobile money application in Nigeria.

-

Integrated loan app

-

Secure fixed or flexible savings

-

POS system

-

Virtual and physical card

Kuda on the other hand is also very good when it comes to features, what opay uses to best is the availability of POS devices for merchants, Cashback on airtime purchases as well as instant loan financing with okash.

Talking about features, I’ll give it to opay over kuda.

Loan

Again opay is better in the loan aspect, with the integration of Okash you can easily get a loan, although the interest is not that friendly, it’s still better than Kuda mfb.

Kuda gives overdrafts to qualified users, these are users who have used the app for a certain period of time and have saved or transact to a certain amount of money.

How much money and time you’ll spend before being eligible is not stated by kuda and according to them, you’ll have to use the application continuously till you’re eligible.

Kuda vs opay fees

Kuda microfinance bank gives free 25 transfers in a month, after you’ve exhausted that, you’ll be charged 10 Naira for every transfer till the end of the month.

Opay on the other hand gives unlimited free transfers, you don’t pay for making transfers in the opay application.

Savings

Here, the savings mode on both apps are almost Identical.

They both have:

- Flexible savings

- Fixed savings

- Spend and save

Opay has two other savings mode, which is a safe box and target savings.

The safe box here is just an extension of the fixed savings, the difference is you can activate automatic weekly or monthly savings to the safebox account.

Target savings, on the other hand, is for saving towards a target such as a phone purchase or School fee, you have the choice to choose what you’re saving for.

When it comes to savings, both opay and kuda are good and offer great choices to choose from.

Security

When it comes to security, both opay and kuda are extremely secure, there is both PCI DSS compliance. Both on their end and on your end, they have provided means to ensure your funds are secure at all times.

As a user make sure your mobile banking application PIN is only known to you and ensure to also set up fingerprint unlock, with this, no one can tamper with your account.

For deposits, Both opay and Kuda are insured by the Nigerian deposit insurance commission (NDIC), As such your funds are as secure as possible.

Check Opay website for their official security statement

And here for kuda microfinance bank security statement

User feedback and complaints

For opay, After analyzing feedback from users, the main issue seems to be about the network, for the period of time I’ve used the opay application, I do get the system busy error, it’s not funny in any way and can ruin your plans if you wanted to do a quick transaction. I hope opay looks into this and try to get a solution as soon as possible.

As for Kuda microfinance bank, there are no specific pressing issues just feedback from users expressing random issues they’re facing, some about savings, some about network and notifications, and the rest, so even with the good ratings kuda has, there is still enough work to be done in other to make the application better.

Reasons to choose opay

Why should I choose opay over kuda?

- OPay is CBN-licensed, NDIC-insured, and trusted by over 18 million consumers.

- Open an account quickly and easily using your phone number, NIN, BVN, or other national forms of verification, and take advantage of incredible welcome incentives.

- Manage all payments from a single app and take advantage of free transfers and transaction bonuses.

- You get bonused free debit cards

- You earn an annual interest rate of up to 15% on flexible savings with daily interest and unrestricted withdrawals

- Opay customer service is available 24 hours a day, seven days a week.

Reasons to choose kuda

Why Should I choose kuda over opay?

- You can create an account in minutes.

- Kuda offers 25 free transfers per month as well as free debit and credit alerts.

- You save and plan effortlessly with kuda saving and budgeting features – earning up to 15% yearly interest!

- When you use your Kuda account on a regular basis, you qualify for instant overdrafts and borrow money when you need it

kuda vs opay similarities

Opay and kuda have some similarities that recognize them as a mobile banking application, the similarities are:

- Both opay and kuda can be accessed through mobile app as well as web using an internet browser

- You can use both kuda and opay to save money

- You can send and receive money on both apps via cash deposit, online transfer or ussd transfer

- both offers free virtual as well as physical debit cards that can be used for national transactions

- Both offers annual percentage rate of UpTo 10% on fixed deposit of funds

- Both apps gives access to credit, with varying interest rates

kuda pros and cons

Pros:

- Very secure banking experience

- Application is very stable, you hardly encounter bugs or hiccups

- Very clear and straight to point user interface, beneficial to people just starting out

- Free 25 transfers monthly

- Fast transactions confirmation, transfers takes less than 2 minutes to appear, this is great for people running transfer centered business.

- Access to POS device (coming soon)

Cons:

- Lacks some features like bonuses and cashbacks

- Referral system doesn’t work all the time

- No SMS alert, for people that would love that though

- Loan takes forever to be eligible if you don’t receive large sums to your account

Opay pros and cons:

Pros:

- Cashbacks and bonuses are available

- Wide range of products are being integrated

- Fast access to loan via okash or Easemoni

- Access to POS devices

Cons:

- Lacks stability

- Sometimes has network issues

- User interface can be overwhelming and confusing at first

Kuda vs opay which is better?

Both kuda and opay are really good apps and either of them can be good for you, depending on your specific needs. If what you want is an app that works like a traditional banking system, where you can save money, pay bills, make transfers, and get access to credit then kuda is for you, but if you need more than that you’ll be better off with opay as you’ll get access to more exciting features such as access to POS devices, bonuses, and cashbacks, fast loan access albeit higher interest rates.

Thanks for stopping by.