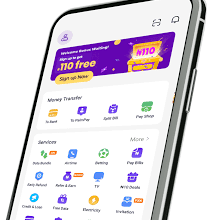

Opay Registration: How to Open an Account with Opay, How To Use Opay App for Payments, Sending and Receiving Money

How to Open an Account with Opay/How To Use Opay App for Payments, Sending and Receiving Money.

In this article, I’ll be sharing with you articles on “how to open an account with Opay”, “How to use Opay App for payment”, and “how to send and receive money using Opay”.

Those are the 3 key focuses of this article.

In recent times, you might have known that Opay remains one of the top and leading Fintech companies in Nigeria offering different kinds of services and incentives that keep them growing to date.

Everything mentioned above: how to open an account with Opay”, ” How to use Opay App for payment, ” and how to send and receive money using Opay” are the key focuses in this article I want to share with you.

Read: Top 10 Financial Business Loan Banks And Companies In Australia in 2023

However, I wouldn’t like to take much of your time below is everything you need to know about the above topics starting from “how to open an account with Opay”:

OPay Registration: How To Create An Account With Opay

Opay is a financial technology company that provides mobile payment and financial services to its customers in Africa. If you want to open an account with Opay, follow these steps:

- Download the Opay app from the Google Play Store or Apple App Store or from any reputable app downloading store.

- Install the app and launch it on your device.

- Click on the “Register” button to sign up for an account.

- Enter your phone number and create a password (Strong Password Must Be Used).

- Verify your phone number by entering the OTP code that will be sent to your phone.

- Once your phone number is verified, complete your registration by filling out the required personal details.

Those are the simple steps on how to open an account with Opay in Nigeria.

How To Use Opay App for payment

If you want to use Opay App for payment the following guidelines will show you how to use Opay App for payment:

- Open the Opay app on your device.

- Click on the “Payment” icon on the home screen.

- Select the type of payment you want to make (e.g., airtime recharge, bill payment, etc.).

- Follow the prompts to enter the required information, such as the amount to be paid and the recipient’s details.

- Confirm the transaction and enter your PIN or fingerprint to authorize the payment.

That’s all on how to use Opay App for payment on utility bills, recharge, etc.

Read Also: How To Get A Loan From First Bank In Nigeria With Or Without Collateral in 2023

How To send money using the Opay app

To send money using the Opay app, follow these steps:

- Simply open the Opay app on your device.

- Click on the “Transfer” icon on the home screen.

- Select the recipient’s phone number from your contact list or enter it manually.

- Enter the amount to be sent and any other required details.

- Confirm the transaction and enter your PIN or fingerprint to authorize the transfer.

How To receive money using the Opay app

To receive money using the Opay app, follow these steps:

- Open the Opay app on your device.

- Click on the “Receive” icon on the home screen.

- Enter the amount to be received and any other required details, such as the sender’s name or phone number.

- Share your Opay wallet number or QR code with the sender.

- Wait for the sender to complete the transaction, and the money will be credited to your Opay wallet.

Everything you need to know about how to open an account with Opay”, ” How to use Opay App for payment “,” and how to send and receive money using Opay” has been shared with you above, kindly follow the steps to ensure you successfully get it done.

Frequently Asked Questions On How to use Opay App for payment, “how to send and receive money using Opay”

Here are some frequently asked questions (FAQs) you should know:

What is Opay?

Opay is a financial technology company that provides mobile payment and financial services to its customers in Africa.

Is Opay legit?

Yes, Opay is 100% legit and safe for use by everyone.

How do I send money using the Opay app?

To send money using the Opay app, you need to launch the app, select the transfer option, enter the recipient’s phone number or select it from your contact list, enter the amount to be sent and any other required details, confirm the transaction, and authorize the transfer with your PIN or fingerprint.

Is Opay safe and secure?

This is one of the oldest questions some people have been asking, however, I’d tell you Opay takes the security of its customers’ transactions seriously and uses encryption and other security measures to protect their personal and financial information so it is safe for use.

Can I use Opay outside Africa?

Unfortunately, Opay is currently available only in Africa, and its services are limited to the countries where it operates.

Does Opay use ATM card?

Yes, Opay does use ATM cards, as it partners with various banks to provide financial services to its users.

Is Opay a prepaid bank?

No, Opay isn’t a prepaid bank, but rather a financial technology (fintech) company that offers digital payment solutions and other financial services.

Is Opay a wallet?

Opay is a wallet, as it allows users to store and manage funds within its platform.

How much is Opay ATM?

The cost of an Opay ATM card may vary as it depends on your location and the specific.

Is Opay a MasterCard?

No, Opay does not issue MasterCard, but instead, it partner with MasterCard to provide card services to its amiable users.

How much does Opay charge?

Opay allows users to withdraw cash from their Opay wallet at designated ATMs.

However, for withdrawals below the sum of N20,000, Opay isn’t will charge you 0.5%. Also, for withdrawals above N20,000, you’ll be charged a flat rate of N100.

For a deposit, of N5000 and above you’ll be charged a flat rate of N10.

How much can I make from POS?

The amount of money you can make from a POS machine depends on several factors, such as the number of daily transactions, and the transaction fees.

However, I’ve personally seen someone located in a good business location making more than N2,000 a day, which is more than the salary of some government and private organization workers.

What is CBN saying about POS?

Research has shown that the Central Bank of Nigeria (CBN) has been promoting the use of POS machines to drive financial inclusion and reduce cash-based transactions in the country.

Does Opay require OTP?

Absolutely Yes. O recently open an account with Palmpay and during the account opening process, they requested an OTP that they sent to me.

Opay requires OTP (One-Time Password) for certain transactions to enhance the security of its platform and prevent fraud.

Which bank in Nigeria uses OTP?

Most banks in Nigeria use OTP as a security measure for online and mobile banking transactions to prevent fraudulent activities.

Which bank owns Opay?

Opay is not owned by any financial institution in Nigeria, rather, it is owned by Opera Software, a Norwegian company that provides web browsers and other internet-related services.

What is Opay full name?

Opay’s full name is OperaPay Inc.

Is Opay approved by CBN?

Yes, Opay is approved by the Central Bank of Nigeria (CBN) to provide financial services in the country.

Which country owns Opay?

Opay is a Chinese-owned country that has become one of the largest fintech in Nigeria.

What is Opay full name?

Opay’s full name is OperaPay Inc.

Can Opay send money internationally?

Opay primarily operates in Nigeria and some other African countries and provides financial services within the country.

Opay does not offer international money transfer services at the moment, might be possible later.

Can Opay be used in USA?

No, Opay is currently not available for use in the USA, I’ve mentioned earlier that it doesn’t serve internationally.

How many countries is Opay in?

Opay is currently available in Nigeria, Kenya, and South Africa.

What is Opay transfer limit?

The transfer limit on Opay varies and depends on the country and the regulations in that country.

In Nigeria, for example, the transfer limit on Opay is currently set at N100,000 per transaction and N300,000 daily.

Can Opay transfer to another bank?

Yes, Opay can transfer funds to other banks in the same country, either to other fintech companies or to commercial banks e.g Access bank, GTBank, First Bank, etc.

Can USSD transfer to Opay?

Yes, USSD transfer can be used to transfer funds to Opay in a country like Nigeria.

Can GTB transfer to Opay?

Yes, GTB (Guaranty Trust Bank) can transfer funds to Opay in Nigeria.

Can you withdraw from Opay?

Yes and why not? You can always withdraw funds from your Opay account at designated Opay agents or partner banks.

Is Opay a bank?

No, Opay is not a bank. It is a financial technology company that provides various digital financial services, such as mobile payments, remittances, and lending.

Can I invest in Opay?

Yes, but you should understand that Opay does not directly offer investment options but on their other platform known as Owealth which is specifically built for investments.

How do I benefit from Opay?

Opay offers various benefits to users, this includes convenient and secure mobile payments, access to loans and other financial services, and discounts and rewards for using the platform.

Is Opay good for saving money?

Opay offers some savings features, such as the ability to earn interest on savings in certain accounts.

How reliable is Opay account?

Opay has invested in robust security measures and technologies to ensure the reliability and safety of its platform.

However, like any financial service, there is always a risk of fraud or other issues, so you as a user, should take appropriate precautions and monitor your accounts regularly.

Is Opay account safe?

Opay is a mobile payment platform that allows users to carry out various financial transactions.

In terms of safety, Opay has implemented various security measures such as two-factor authentication, biometric authentication, and encryption to ensure that users’ accounts and transactions are secure.

Which is better between Opay and Kuda?

Both Opay and Kuda are mobile payment platforms that offer similar services.

However, the choice between the two platforms depends on personal preference and the availability of services in your location.

Does Opay have a banking license?

Opay is regulated by the Central Bank of Nigeria (CBN) through its partnership with a licensed financial institution.

This partnership allows Opay to offer certain banking services.

Can my Opay account be hacked?

Like any other online account, an Opay account can be hacked if the user’s login credentials are compromised or if there is a security breach on the platform.

However, Opay has implemented various security measures to prevent unauthorized access to users’ accounts, yet if someone is able to get through your phone, it can be easily accessed and hacked.

Can Opay account be frozen?

Yes, but this rarely happens. An Opay account can be frozen if there are suspicious activities on the account or if the platform suspects fraudulent activities.

However, the account can be unfrozen after proper verification.

Is Opay Regulated?

Yes, Opay is regulated by the Central Bank of Nigeria (CBN).

Hackers can steal your Opay account by using various methods such as phishing scams, malware, and social engineering. They may also use weak passwords or exploit vulnerabilities in the platform’s security.

How do hackers steal your account?

Hackers can use various passwords to gain access to your Opay account,

What password does hackers use?

Hackers use different kind of passwords just to gain access to your account, these password includes and is not limited to “123456,” “password,” and “qwerty.” They may also use brute force attacks to crack your password.

Can someone hack into your account by calling you?

It is possible for someone to hack into your Opay account by calling you and posing as a customer service representative or a friend who needs your account details.

I’ve once fallen victim to this, that was in the year 2018, and all my money was wiped off.

However, I’d advise you not to disclose your login credentials to anyone, even if they claim to be from Opay.

Conclusion

Opay is a financial technology company that provides mobile payment and financial services to its customers in Africa.

To open an account with Opay, you need to download the Opay app, install it, and register for an account.

To use the Opay app for payments, you need to launch the app, select the type of payment you want to make, enter the required information, confirm the transaction, and authorize the payment.

To send and receive money using the Opay app, you need to launch the app, select the transfer or receive the option, enter the required information, and confirm the transaction.

Opay takes the security of its customers’ transactions seriously and uses encryption and other security measures to protect their personal and financial information.