Eversend Vs Chipper Cash: Differences, Similarities, Which is Better?

This post contains a comparison between two great fintech companies in Nigeria. We’ll be comparing their differences, their similarities, and features, and finally, you shall have an Idea of which one is better from the comparisons made.

What Is Eversend?

Eversend is a financial technology (fintech) company that offers a multi-currency digital wallet and financial services platform.

It aims to provide individuals and businesses with convenient, affordable, and secure solutions for managing their money and making international payments.

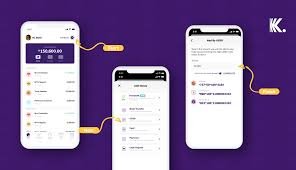

Eversend’s primary product is its mobile application, available on both iOS and Android devices.

Related Post: Flutterwave VS Chipper Cash, Which is better and why?

The app allows users to hold and exchange multiple currencies, send and receive money across borders, make bill payments, and access other financial services.

It supports a wide range of currencies and offers competitive exchange rates.

One of Eversend’s key features is its ability to facilitate cross-border transfers without the need for a traditional bank account.

Users can send money to friends, family, or business partners internationally, even if the recipient does not have an Eversend account.

The funds can be received in local currency or converted into another currency within the app.

Eversend also offers a physical debit card that users can link to their Eversend wallet.

This card allows users to withdraw cash from ATMs and make payments at point-of-sale terminals globally, leveraging the currencies available in their wallets.

What is Chipper Cash App?

Like Eversend, Chipper Cash is also a financial technology (fintech) company that provides a mobile payments and remittance platform primarily focused on Africa.

The company aims to simplify and enhance financial transactions, including money transfers, bill payments, and peer-to-peer payments, within and across African countries.

Chipper Cash app offers a mobile application that allows users to send and receive money across borders, often without transaction fees.

It supports various African currencies and enables users to convert funds between different currencies within the app.

One of the outstanding features of Chipper Cash is its ability to carry out cross-border transactions and remittances.

You can send money to friends, family, or business partners in different African countries, leveraging the mobile app’s services.

The recipient can receive the funds in their local currency and withdraw them from their mobile wallet or link their bank account to the app for seamless transfers.

Chipper Cash also allows users to make payments for utilities, bills, and other services directly from the app.

Also, it supports peer-to-peer transactions, enabling users to send money to each other instantly.

Not finished yet, Chipper Cash has expanded its services beyond payments and remittances.

It has introduced features like investment options and cryptocurrency trading, allowing users to invest and trade within the app.

These additional services aim to provide users with more financial opportunities and convenience.

Eversend Vs Chipper Cash features and differences

Here, we’re going to take a look at Eversend Vs Chipper Cash features and see the clear differences. Kindly read on:

Money Transfer

Both Eversend and Chipper Cash allow users to send and receive money across borders.

Eversend offers multi-currency support, competitive exchange rates, and the ability to send money to recipients without a traditional bank account.

Chipper Cash on the other hand focuses primarily on African countries, offering seamless cross-border transfers and the convenience of sending funds to friends, family, and businesses within the continent.

Currency Conversion

Another comparison we can’t overlook is their currency conversion. Eversend provides users with the flexibility to hold and exchange multiple currencies within their digital wallet.

It supports a wide range of currencies and offers competitive rates for currency conversion.

Chipper Cash, on the other hand, focuses on African currencies and allows users to convert funds between different African currencies within the app.

Bill Payments

Both platforms “Eversend and Chipper Cash” offer bill payment services, allowing users to conveniently pay their utilities and other bills directly from the app.

This feature provides users with the convenience of managing their financial obligations from a single platform.

Peer-to-Peer Payments

Chipper Cash emphasizes peer-to-peer payments, enabling users to send money to each other instantly.

This feature facilitates quick and easy transactions between friends and acquaintances. While Eversend also supports peer-to-peer payments, it places more emphasis on international transfers and currency exchange.

Additional Services

Eversend goes beyond payments and remittances by offering additional financial services such as virtual debit cards, virtual account numbers, and personal loans.

This expands the range of financial tools available to users.

Chipper Cash has also started to introduce additional services like investment options and cryptocurrency trading, allowing users to invest and trade within the app and earn interest on their investments.

Geographic Focus

Eversend targets a broader international market, providing services for individuals and businesses globally.

Chipper Cash, on the other hand, primarily focuses on African countries, catering to the specific needs of the African market and facilitating transactions within the continent.

Similarities: Eversend Vs Chipper: Which is better?

If you carefully and gently read from the start, you should notice some similarities between the two of them. However, I have made it more clearer and understandable here.

Eversend and Chipper Cash have some similarities in terms of their core offerings and features.

Both platforms provide mobile payment and remittance services, allowing users to send and receive money across borders. They aim to simplify financial transactions and promote financial inclusion. Here are some key similarities:

Cross-border Transfers

Both Eversend and Chipper Cash allow cross-border transfers, which enable users to seamlessly send money to recipients in different countries.

They aim to make international remittances more accessible and affordable.

Mobile Applications

Eversend and Chipper Cash offer mobile applications available on iOS and Android devices.

Users can perform transactions, manage their funds, and access various financial services through these apps.

Bill Payments

This is one of the primary features of the two fintech companies.

Both platforms allow users to make bill payments directly from their mobile applications.

Read Also; Flutterwave VS Chipper Cash, Which is better and why?

This feature provides convenience by enabling users to manage their utility bills and other payments within a single platform.

Peer-to-Peer Payments

Eversend and Chipper Cash support peer-to-peer payments, allowing users to send money to each other quickly and easily.

This feature is useful for splitting expenses, repaying debts, or sending money to friends and family.

My final verdict on Eversend Vs Chipper Cash, which is better?

To choose which is better Eversend and Chipper, you need to carefully review the features, similarities, and differences provided in this article.

While I can’t be specific on which is better, I’ll recommend you to see some factors which come make you quickly decide on which one you should go for between the two:

Eversend

Eversend may be more suitable if:

- You require a broader international focus and need to send or receive money globally.

- You frequently deal with multiple currencies and need the flexibility to hold and exchange different currencies within your digital wallet.

- You are interested in additional financial services like virtual debit cards, virtual account numbers, and personal loans which are not offered by its competitor “Chipper Cash”.

- You prioritize competitive exchange rates and a wide range of currency options.

Chipper Cash

Chipper Cash may be more suitable if:

- Your primary focus is on the African market, and you need to send or receive money within African countries.

- You prefer a platform that offers seamless cross-border transfers within Africa and supports African currencies.

- You value the convenience of peer-to-peer payments and want to easily send money to friends and family within the continent.

- You are interested in emerging features like investment options and cryptocurrency trading within the app.

With that, you should be able to take the right step on which to choose.

NOTE: Choosing one does not render the other useless, only depends on your specific need.

FAQs on Eversend Vs Chipper Cash: Differences, Similarities, which is Better?

Below are frequently asked questions on “Eversend Vs Chipper Cash: Differences, Similarities, which is better?:

How secure are Eversend and Chipper Cash?

Both Eversend and Chipper Cash prioritize security.

They employ encryption and other security measures to protect user data and transactions.

However, it’s always advisable to follow best practices which start with using strong passwords and enabling two-factor authentication to enhance security.

Can I use Chipper Cash without a bank account?

Yes, Chipper Cash allows users to use their services without a traditional bank account.

It provides mobile wallet functionality, allowing users to store and manage their funds within the app.

How long do transfers take with Eversend?

The time it takes for transfers to be completed can vary depending on factors such as the destination country, currency, and the recipient’s bank processing times. However, most times transfer is complete instantly without disruption.