Swift Naira Loan App Download, How to Apply, Requirements

Swift Naira Loan App Download, How to Apply, Requirements

Emergencies and unexpected financial needs can arise at any time, leaving us searching for reliable solutions to quickly bridge the gap.

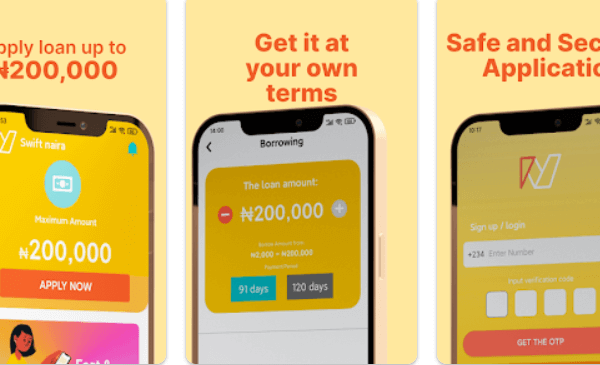

Swift naira is a game-changing financial technology company in Nigeria that offers hassle-free loans without the need for collateral or extensive documentation. In this guide, I’ll walk you through what you need to know on how to apply for swift naira loan, swift naira loan download, and requirements.

Here is everything you need to know;

Swift Naira Loan App Download, How to Apply, Requirements

Swift Naira has swiftly emerged as a trustworthy and reliable loan provider in Nigeria.

Designed to cater to individuals seeking instant financial assistance, Swift Naira aims to make the borrowing process seamless and stress-free.

Whether it’s a medical emergency, educational expenses, or other urgent financial needs, Swift Naira’s platform provides a convenient solution.

Swift Naira Loan App Download (How to download Swift Naira loan App)

Downloading the Swift Naira Loan App is quite simple and requires approximately 10MB.

Read: Creditwise Loan Nigeria, Reviews, How to apply, Interest Rate and Customer Care Number

Here’s how to download swift naira loan app from the Google play store:

Ensure your smartphone has approximately 10 MB of available space.

- Head to the Google Play Store on your device.

- Search for “Swift Naira loan app” in the search bar.

- Click the “Install” button to initiate the download.

- Once downloaded, launch the app and explore its features.

Swift Naira Loan Requirements

To be eligible for a Swift Naira loan, certain criteria must be met. These criteria include:

- Residency in Nigeria.

- You must be between 18 and 60 years.

- Possession of a valid bank account with a Nigerian commercial bank.

- Provision of your BVN (Bank Verification Number) and NIN (National Identification Number).

- Possession of a valid government-issued identification, such as a voter’s card, driver’s license, or passport.

- Demonstrable proof of a legitimate and stable source of income.

Meeting these eligibility requirements positions you to take advantage of Swift Naira’s loan offerings.

How to Applying for Swift Naira Loan

Applying for swift naira loan is simple and stress free. Here’s how to apply for swift naira loan in 2023:

If you’re an existing user, log in to your Swift Naira account. New users need to sign up to create an account. Ensure you have the correct version of the app installed.

Complete the loan application form within the app, providing accurate and verifiable information.

Submit the application, after which it will be reviewed and evaluated by the Swift Naira team.

Upon approval, the loan amount will be disbursed to your account within a matter of minutes.

It’s essential for you to carefully review the terms and conditions outlined in the Disclosure Statement before proceeding with the loan transaction.

FAQs On Swift Naira Loan App Download, How to Apply, Requirements

Here are helpful frequently asked questions on how to apply for swift naira loan, app download and requirements:

What are the eligibility requirements for a Swift Naira loan?

To be eligible for a Swift Naira loan, you need to meet the following criteria:

- Be a resident of Nigeria.

- Be between 18 and 60 years old.

- Have a valid bank account with a Nigerian commercial bank.

- Provide your BVN (Bank Verification Number) and NIN (National Identification Number).

- Possess a valid means of identification (voter’s card, driver’s license, or passport).

- Have a stable and legitimate source of income.

How much can I borrow from Swift Naira?

You can borrow a minimum of N2,000 and a maximum of N 600,000 from Swift Naira, depending on your eligibility and financial circumstances.

What is the interest rate for Swift Naira loans?

Swift Naira offers competitive interest rates, with processing fees ranging from 0.1% to 0.35%. The maximum Annual Percentage Rate (APR) is capped at 24%, making it an affordable option for borrowers.

How long do I have to repay the loan?

Swift Naira provides flexible repayment plans. The loan term typically ranges from 91 days to 365 days, allowing you to choose a repayment period that suits your financial situation.

How do I contact Swift Naira for assistance?

You can contact Swift Naira through the following means:

Call: 08184250495

Email: Swiftnairahelp@yahoo.com

Head Office Address: 125, Olusegun Osoba Way, Oke Ilewo, Abeokuta, Ogun State, Nigeria.

Is the Swift Naira loan app safe and secure?

Yes, Swift Naira places a high priority on the security and confidentiality of your financial information.

The loan app is designed with security measures to protect your data and ensure a safe borrowing experience.

Can I apply for a Swift Naira loan if I don’t have a smartphone?

No, you need a smartphone to access and use the Swift Naira loan app. The app is designed to provide a convenient digital platform for loan applications.

Can I repay my swift naira loan before the end of the loan term?

Yes, you can repay the loan before the end of the loan term without any penalties.

Swift Naira encourages responsible borrowing and provides borrowers with the flexibility to manage their loans according to their financial capabilities.

How quickly will I receive the loan after approval?

Once your loan application is approved, the loan amount will be disbursed to your account within a few minutes. This quick disbursement process ensures that you can address your financial needs promptly.

Can I extend my Swift naira loan repayment period if needed?

Swift Naira offers flexible loan terms, but it’s essential to adhere to the agreed-upon repayment schedule.

If you encounter difficulties in repaying the loan, I’ll recommend getting in touch with Swift Naira’s customer support for guidance and assistance.