If you want to learn how to open an Opay account without BVN, you are on the right page. Opay is a mobile payment and financial services platform that operates in some countries in Africa.

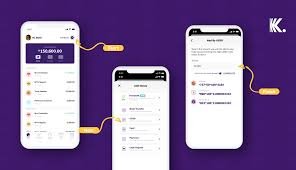

It allows users to carry out various transactions such as sending and receiving money, paying bills, buying airtime, and ordering food and groceries online.

Think of it as a virtual wallet that you can use to manage your money conveniently from your smartphone.

With Opay, you can easily pay for goods and services without having to handle cash, which makes it a safe and secure way to handle your finances.

What is BVN and its importance

Some other things you should know before learning how to open an Opay account without BVN today is the importance.

BVN stands for Bank Verification Number and it’s a unique identification number that is assigned to every bank customer in Nigeria.

- The BVN system was introduced by the Central Bank of Nigeria to help curb fraud and other illegal activities in the banking sector.

- The BVN is important because it serves as a means of verifying and authenticating the identity of bank customers when they carry out transactions.

- It helps to reduce cases of identity theft, money laundering, and other financial crimes. With the BVN, you can easily open and operate a bank account, and it also ensures that your personal and financial information is protected.

Benefits Of opening an Opay account without BVN

Opening an Opay account without a BVN is possible, but it comes with some limitations. Here are some benefits you can enjoy:

Easy and quick registration

You can sign up for an Opay account in minutes without the need for a BVN, making the process faster and more convenient.

Basic transactions

With an Opay account without BVN, you can perform basic transactions such as transferring money to other Opay users, paying bills, and buying airtime and data.

Privacy

Since you are not providing your BVN, your personal information is not linked to your Opay account, which could be a benefit if you are concerned about your privacy.

No restrictions on using funds

You can use the funds in your Opay account without any restrictions, which means you can easily buy goods and services online or make payments without worrying about transaction limits.

Disadvantages of opening an Opay account without BVN

While it’s possible to open an Opay account without a BVN, there are some disadvantages you should be aware of:

Limited functionality

If you open an Opay account without a BVN, you’ll be limited to basic transactions like transferring money to other Opay users, paying bills, and buying airtime and data.

Read: How to verify opay account and how to check Opay account number

You won’t have access to features like higher transaction limits, access to loans, or the ability to withdraw funds from your Opay account to your bank account.

Security concerns

Without a BVN, Opay cannot properly verify your identity, which could pose a security risk.

Your account could be vulnerable to fraud, identity theft, or other forms of cybercrime.

Difficulty resolving issues

If you encounter any issues with your Opay account, it may be more difficult to resolve them without a BVN.

This is because Opay’s customer support team may not be able to verify your identity without a BVN, which could make it challenging to address any issues you may have.

No link to your bank account

Without a BVN, your Opay account is not linked to your bank account.

This means you won’t be able to withdraw funds from your Opay account to your bank account, which could be inconvenient if you need to access your funds urgently.

Opay Registration: How to open an Opay account without BVN

Opening an Opay account without a BVN is a simple and straightforward process. Here’s how to do it:

Download the Opay app

The first step on how to open an Opay account without BVN is to download the app. Yes, you’ll need to download the Opay app from your app store.

Playstore for Android and Apple app store for iOS users (recommended).

Sign up

Open the app and select “Sign Up”. You’ll be asked to provide your phone number and email address.

Verify your phone number

Opay will send a verification code to your phone number. (The phone number you used to sign up) Enter the code into the app to verify your phone number.

Set up your profile

You’ll be asked to provide some basic information such as your name and date of birth etc.

Create a password

Create a strong password that you’ll use to log in to your Opay account.

Skip BVN registration: When prompted to provide your BVN, select “Skip for now” to continue without linking your BVN to your Opay account.

Start using your Opay account

Congratulations! You’ve successfully opened an Opay account without a BVN. You can now start using your account to make transactions such as transferring money to other Opay users, paying bills, and buying airtime and data.

Related: How to open Kuda bank account without BVN

Remember that while you can enjoy the benefits of using Opay without a BVN, it’s recommended that you link your BVN to your account to enjoy additional features and benefits and ensure the security of your account.

Frequently Asked Questions On How To Open Opay Account Without BVN

Here are some frequently asked questions on how to open Opay account without BVN:

How do I open an OPay account on my phone?

To open an OPay account on your phone, you need to download the OPay app from your app store.

Once you’ve downloaded the app, sign up by providing your phone number, email address, and other basic information.

You can then link your BVN to your account, although it’s possible to open an account without a BVN.

How do I create a BVN for OPay?

You cannot create a BVN for OPay as it is a unique identification number assigned to every bank customer in Nigeria by the Central Bank of Nigeria.

To link your BVN to your OPay account, simply provide your BVN during the account registration process or add it later in the app.

What do I need to open an OPay account?

To open an OPay account, you need a smartphone, a phone number, and an email address.

You’ll also need to download the OPay app from your app store.

If you want to link your BVN to your account, you’ll need your BVN as well.

How much can I receive in my OPay account?

The amount you can receive in your OPay account depends on the transaction limits set by OPay.

These limits may vary depending on factors such as your account type and the transaction type.

For example, the daily transaction limit for an unverified OPay account is N50,000, while a verified account has a limit of N200,000. You can check your transaction limits within the OPay app.