Creditwise Loan Nigeria, Reviews, How to apply, Interest Rate and Customer Care Number

Creditwise Loan Nigeria, Reviews, How to apply, Interest Rate and Customer Care Number

Are you in need of urgent funds to cater to your expected or unexpected needs? Creditwise Loan Nigeria might be the solution you’ve been searching for. This article will certainly provide you with a comprehensive overview of how to apply for creditwise loans, Creditwise interest rates, creditwise reviews, and customer care numbers. Also, answers to some frequently asked questions about creditwise are also included at the end of this article.

Let’s get going!

I have provided comprehensive guides on creditwise reviews: how to apply for creditwise loan, creditwise interest rate, and customer care number. Kindly read on:

Creditwise Loan Interest Rate

One of the most appealing aspects of Creditwise loans is their reasonable interest rates.

With loan amounts ranging from N5,000 to N500,000 and repayment periods spanning from 14 to 365 days, Creditwise provides the flexibility you need to manage your loan efficiently.

The annual interest rates for Creditwise loans fall within the 12% to 20% range.

To illustrate, consider borrowing N5,000 with a repayment period of 180 days. In this scenario, the interest charged at a 12% rate would amount to N600.

This means the total repayment, including both the principal and interest, would be N5,600.

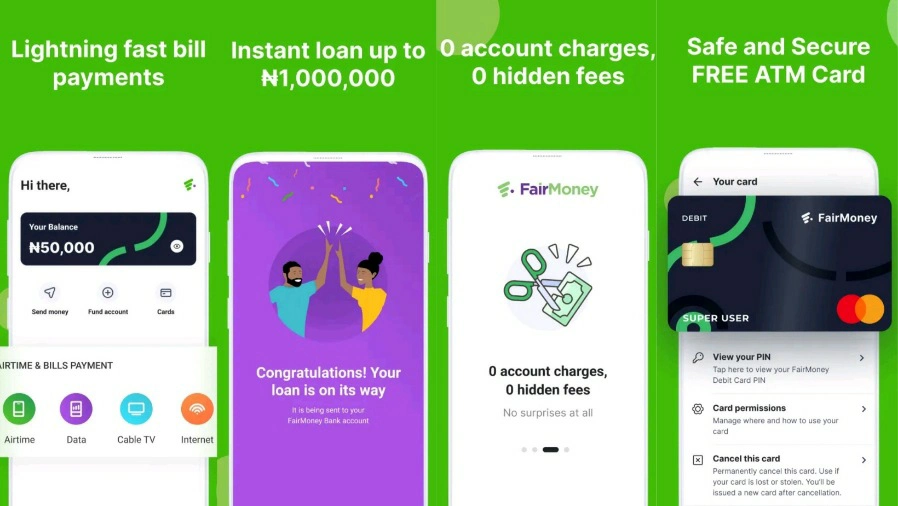

How to Apply For CreditWise Loan In Nigeria

Don’t Know how to apply for creditwise loan in Nigeria?

Here’s how to get started:

Download and Install the App: Head over to the Google Play Store on your Android device. Search for “CreditWise Loan App” and download the official app. Once downloaded, install it on your device.

Create an Account: Launch the CreditWise app after installation. Begin by creating an account within the app.

During registration, ensure that you use the phone number registered with your BVN (Bank Verification Number).

This is important as an OTP (One-Time Password) will be sent to this number for verification purposes.

Fill in Your Personal Information: After account creation, provide your personal details as required by the app.

This includes your full name, date of birth, and other necessary information. Make sure to also input your BVN accurately.

Link Your ATM Card: As part of the registration process, you’ll need to link your ATM card to your CreditWise account.

This step is mandatory. Please note that a fee of N30 will be charged to validate the card’s authenticity. However, this fee is refundable.

OTP Verification: Once you’ve linked your ATM card, an OTP code will be sent to the phone number registered with your BVN. Input this OTP code in the required field within the app.

Credit Score Analysis: After submitting your loan application, the app’s software will analyze your credit score.

The results of this analysis will be displayed within the app. This step helps determine your eligibility and the loan amount you can access.

Identity Verification: To further ensure the security of your application, the app will require you to take a clear live selfie.

This selfie will be used to verify your identity. Ensure you use a smartphone with sufficient memory to capture and upload the selfie.

Loan Terms and Amounts: Depending on various factors including your credit score, you’ll be provided with loan term options and the corresponding interest rates. You can choose the term that suits you best.

For instance, if you select a loan term of three months and borrow NGN20,000, the service fee and interest rates will be calculated accordingly.

Repayment: Upon approval of your loan, it’s important to note the repayment terms. The CreditWise app will provide you with information about your repayment schedule, including the total amount to be repaid.

Creditwise Reviews & Legitimacy

As of the time of writing, CreditWise is a legitimate platform to secure loans without the requirement of submitting documents or collateral.

Read: Nice Naira Loan App Download, is NiceNaira Legit? Interest Rates, How to Apply

They have mixed reactions from satisfied and unsatisfied customers. However, before you apply for creditwise loan in Nigeria, ensure you check their reviews and rating in the app store, this will help you in making an informed decision.

Creditwise Customer Care Phone Number, Whatsapp Number, Email and Office Address

In case you need to get in touch with creditwise customer care, kindly reach out to them via the following channels:

Email: support@creditwise.loans. Additionally, if you prefer face-to-face communication, their office is located at 23a Moleye Street, Alagomeji-Yaba 234-01, Lagos, Nigeria.

FAQs On Creditwise Loan Nigeria

Here are some frequently asked questions on Creditwise Loan Nigeria, Reviews, How to apply for creditwise loan Nigeria, Interest Rate and Customer Care Number:

Can I get an instant loan with Creditwise?

Yes, Creditwise specializes in providing instant loans. Once your loan is approved, the funds are disbursed directly to your account, ensuring you have quick access to the funds you need.

How long can I take to repay my Creditwise loan?

Repayment periods for Creditwise loans range from 91 to 365 days.

This flexibility enables borrowers to select a repayment duration that aligns with their financial capabilities.

What are the interest rates for Creditwise loans?

Creditwise offers annual interest rates that vary from 12% to 20%, depending on the specifics of your loan.

The rate you are offered will be based on factors such as your loan amount, repayment period, and personal creditworthiness.

What loan amounts can I apply for with Creditwise?

Creditwise offers loan amounts ranging from N5,000 to N500,000, allowing you to choose the amount that suits your immediate financial requirements.

How do I apply for a Creditwise loan?

To apply for a Creditwise loan, follow these steps:

- Download the Creditwise app from your app store.

- Fill out the application form with accurate information.

- Await approval, which is often granted instantly.

Once approved, your loan amount will be disbursed to you swiftly.

What are the eligibility criteria for a Creditwise loan?

To be eligible for a Creditwise loan, you should:

- Be a Nigerian citizen or resident.

- Fall within the age range of 22 to 55 years.

- Have a stable source of income.

Can I contact Creditwise customer care for assistance?

Absolutely. If you have any questions or need assistance, you can contact Creditwise customer care through their service email at support@creditwise.loans. Additionally, you can visit their physical office at 23a Moleye Street, Alagomeji-Yaba, Lagos, Nigeria.