Opay Vs M-Pesa: Which Mobile Payment Platform Is Better?

Opay Vs M-Pesa: which is better? Fees, user feedback, features and Legit

This post will give a comparison between two giant digital payment platforms “Opay vs M-Pesa: Which Mobile Payment Platform Is Better?

We all know Opay digital mobile payment as one of the most standard fintech companies in Nigeria, but is it the same with M-Pesa?

You don’t have to worry about answering the questions, just ensure you read this article till the very end to gain full insight into the information it’s trying to pass across to you.

Opay Vs M-Pesa Comparison (Opay And M-Pesa Statistics)

Opay and M-Pesa are both digital payment platforms that have become popular in recent years.

However, while Opay is primarily focused on the Nigerian market, and a few other African countries, M-Pesa is used in several countries across Africa and Asia.

Here’s a comparison of some of the key statistics for Opay and M-Pesa:

Market Presence

M-Pesa is available in several countries across Africa and Asia, including Kenya, Tanzania, Mozambique, and India. While on the other hand, Opay is currently only available in Nigeria and two other Africa countries.

User Base

According to Statista as of 2022, M-Pesa had 52.4 million active users while Opay on the other hand currently had 18 million registered users according to the information obtained from their about us page.

Services Offered

Both Opay and M-Pesa offer a range of services beyond digital payments. Opay offers ride-hailing, food delivery, and lending services and utility bill payments, while M-Pesa offers utility bill payments, mobile banking, and international money transfers.

Transaction Volume

In 2020, research showed that M-Pesa processed over 11 billion transactions with a total value of over $490 billion while in the same year, Opay processed over 60 million transactions with a total value of over $1 billion.

Ownership

Opay is owned by Opera Software AS, while M-Pesa is owned by Safaricom, a telecommunications company in Kenya.

Market Share

M-Pesa has a dominant market share in the countries where it operates.

For example, in Kenya, M-Pesa has a market share of over 90% in the mobile money market. Opay, on the other hand, faces stiff competition from other digital payment platforms in Nigeria.

Features And Functionalities Of Opay And M-Pesa

Comparing Opay Vs M-Pesa, we need to look at their features as well as their functionalities, without, this article is absolutely incomplete.

Read: Top 10 Apps Similar To Opay

Opay and M-Pesa are both digital payment platforms that offer a range of features and functionalities. However, below are some of the key features of each platform:

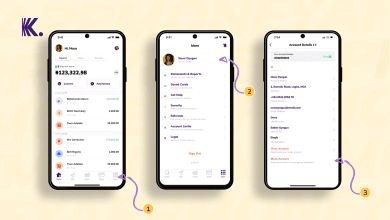

Opay – The Features, and Functionalities of Opay

Comparing Opay Vs M-Pesa, the features, and functionalities of Opay, below are what you should know:

Mobile Payments

One of the most outstanding features and functions of Opay is that it allows its users to make payments and send money to other users through the Opay mobile app.

Ride-Hailing

You might have in one way or the other come across O’ride, Uber or any company that offers riding services, Opay is not excluded.

Opay offers ride-hailing services through its app, allowing users to book rides with ease.

Food Delivery

Opay also offers food delivery services in select cities, allowing users to order food from their favorite restaurants and have it delivered to their doorstep.

Lending

Another outstanding feature of Opay is that it offers loans to users through its app, allowing them to access funds ranging from thousands to millions of naira quickly and easily without collateral.

Airtime Top-Up

Users can buy airtime and data bundles for their mobile phones through the Opay app.

M-Pesa – The Features, and Functionalities of M-Pesa

Opay vs M-Pesa features and functionalities, below are what you should know about the functionalities of M-Pesa:

Mobile Payments

Users can make payments and send money to other users through the M-Pesa mobile app or USSD code.

International Money Transfers

M-Pesa allows users to send and receive money internationally, with partnerships in several countries around the world.

This seems to be more advantageous as it’s not limited to a few countries.

Mobile Banking

Every M-Pesa user can access a range of banking services through the M-Pesa app, including checking account balances, paying bills, and carrying out other transactions.

Bill Payments

Just like Opay, with M-Pesa, users can pay utility bills, such as electricity and water bills, through the M-Pesa app.

Savings And Loans

M-Pesa offers a range of savings and loan products, allowing users to save and borrow money through the app.

As you can see, both Opay and M-Pesa offer a range of features beyond digital payments, with Opay focusing more on ride-hailing and lending services, and M-Pesa offering more banking-related features.

But that is not all, there are still other things to compare in this article (Opay Vs M-Pesa) before coming out with the final result.

Opay Vs M-Pesa: Charges

As you already know these are two different companies owned by different sets of groups and you should expect differences in their charges.

Read Also: How to get a reversal for a failed POS or ATM transaction (All Nigerian banks)

Below is a comparison of their charges:

Transaction Fees

Opay charges a flat fee of 10 Naira (about $0.03) for transactions, while M-Pesa charges a percentage fee that varies depending on the amount being sent and the recipient’s network.

Withdrawal Fees

Opay charges a fee of 100 Naira on a withdrawal of N20,000, while M-Pesa charges a percentage fee that varies depending on the amount being withdrawn.

Opay Vs M-Pesa: Security

Opay Vs M-Pesa, below is what you should know about their security:

User Authentication

Both Opay and M-Pesa require users to authenticate themselves with a PIN or password when accessing the app or making transactions.

Encryption

Both platforms use encryption to protect user data and transactions from unauthorized access.

Fraud Prevention

Both Opay and M-Pesa have measures in place to prevent fraud, including monitoring transactions for suspicious activity and suspending accounts that show signs of fraudulent activity.

Opay Vs M-Pesa: Customer Support

Both platforms have customer support teams that users can contact in case of any issues or concerns with their accounts or transactions.

Opay Vs M-Pesa: Users Feedback And Complaint

Opay and M-Pesa have received feedback and complaints from their users and this is normal, it happens in every business, both online and offline.

However, below are some of the feedback and complaints from users

Opay

Positive feedback

Opay has received positive feedback from users for its ease of use and range of services, particularly for its ride-hailing and lending services.

Negative Feedback

Some users have reported issues with delayed or failed transactions, as well as poor customer service.

Complaints

Users have complained about the high transaction fees and withdrawal fees charged by Opay, including the limited availability of services in some areas.

M-Pesa

Positive Feedback

M-Pesa has received positive feedback from users for its convenience and reliability, particularly for its mobile banking and bill payment services.

Negative Feedback

Some users have reported issues with delayed or failed transactions, as well as network connectivity issues in some areas.

Complaints

Users have complained about the high transaction fees charged by M-Pesa, as well as the lack of transparency in some of the fees charged.

Opay Vs M-Pesa: Similarities

Opay and M-Pesa share some similarities as mobile payment systems. Below are some of their similarities:

Mobile Based

Both Opay and M-Pesa are mobile based payment systems that enable users to seamlessly carry out transactions using their mobile phones.

Secure

They both use encryption and other security measures to protect users’ financial transactions and personal information.

Convenient

Opay and M-Pesa enable users to conduct transactions quickly and conveniently, without the need for cash or physical payment methods.

Bill Payments

Just as Opay allows users to pay bills and purchase goods and services using their mobile phones, the same applies to M-Pesa.

Money Transfer

Both systems enable users to send and receive money to and from other users within the same platform.

Accessibility

Each of these two companies “Opay and M-Pesa” is accessible to people who may not have access to traditional banking services, making it easier for them to participate in the digital economy.

Opay Vs M-Pesa: Advantages And Disadvantages

Opay and M-Pesa are two popular mobile payment systems that offer similar services, yet, they have their own unique advantages and disadvantages. Below is the comparison:

Opay Advantages

Below are the advantages you may derive from using Opay:

Lower Transaction Fees

Opay is a local company, therefore, it offers a competitively low transaction fee compared to M-Pesa which charges higher.

Cashback Rewards

Opay offers cashback rewards on transactions made on its platform, which can be an attractive incentive for users.

Wide Range Of Services

In addition to money transfer and payment services, Opay also offers other services such as ride-hailing, food delivery, and airtime recharge.

Easy To Use

Opay’s mobile app has a user-friendly interface that makes it easy for users to navigate and conduct transactions.

Opay Disadvantages

Some disadvantages are the following:

Limited Reach

Opay is currently only available in a few countries in Africa, which may limit its usefulness for users in other regions.

Limited Acceptance

Opay may not be accepted by as many merchants and businesses as M-Pesa, which could make it less convenient for some users.

M-Pesa Advantages

The advantages of M-Pesa are the following:

Established Network

M-Pesa has a more established network of agents and partners, making it more convenient for users to access its services.

Wider Acceptance

M-Pesa is accepted by a wider range of merchants and businesses, which means that users can use it to make payments in more places.

Higher transaction limits

M-Pesa has higher transaction limits compared to Opay, which could be beneficial for users who need to make large transactions.

M-Pesa Disadvantages

Below are some pros of using M-Pesa:

Higher Transaction Fees

M-Pesa charges higher transaction fees compared to Opay, which could be a drawback for users who conduct frequent transactions.

Limited services

M-Pesa primarily offers money transfer and payment services and does not have the same range of additional services as Opay.

Opay Vs M-Pesa Which Mobile Payment Platform Is Better?

Determining and finally concluding on which mobile payment platform is better between Opay and M-Pesa depends on your personal needs and priorities.

Both platforms offer similar services, but they differ in terms of their transaction fees, range of services, and network of agents and partners.

However, I have carefully selected some factors you may consider when choosing between Opay and M-Pesa, the factors can be seen below:

Transaction fees

If you’re concerned about transaction fees, Opay may be the better choice as it offers lower transaction fees compared to M-Pesa.

Range of services

If what you’re looking for is a platform that offers a wider range of services beyond the money transfer and payment services, then Opay may be the better choice, as it offers other services such as ride-hailing, food delivery, and airtime recharge.

Network Of Agents And Partners

If what you desire is a platform with a more established network of agents and partners, then M-Pesa may be the better choice, as it has been in operation longer and has a more established network.

Acceptance by merchants and businesses

Lastly, if what you want is a platform that is widely accepted by merchants and businesses, then M-Pesa may be the better choice, as it is accepted by a wider range of merchants and businesses.

My Verdict on Opay Vs M-Pesa

As a user, it’s crucial for you to consider your own needs and priorities when choosing the best between Opay and M-Pesa, both platforms are convenient and secure mobile payment services but differ in terms of their strengths and weaknesses.

Whichever you believe is suitable for your needs, I believe I’ve provided enough information you need to choose the one that suits you.

Frequently Asked Questions On Opay Vs M-Pesa

Here are some frequently asked questions on Opay and M-Pesa:

How do I use Opay?

To use Opay, you need to download the Opay mobile app, create an account, and link your bank account or debit/credit card. You can then use the app to send and receive money, pay bills, and purchase goods and services.

How do I use M-Pesa in Kenya?

To use M-Pesa, you need to register for an account with a mobile network operator that supports M-Pesa, such as Safaricom in Kenya.

You can then use the M-Pesa menu on your mobile phone to send and receive money, pay bills, and purchase goods and services.

Which is cheaper, Opay or M-Pesa?

Opay generally has lower transaction fees compared to M-Pesa, although the exact fees may vary depending on the country and specific transaction.

Which is more widely accepted, Opay or M-Pesa?

M-Pesa is generally accepted by a wider range of merchants and businesses compared to Opay, yet the exact acceptance may vary depending on the country and specific location.

Which is better, Opay or M-Pesa?

The answer to this question depends on your specific needs and priorities just as I stated in my verdict above.

Opay and M-Pesa offer similar services, but they differ in terms of their transaction fees, range of services, and network of agents and partners.

You will need to consider your own needs and priorities when choosing between the two.