Opay Products And Services, Opay Fees, Opay Registration Process, Opay Customer Support, Opay Investment

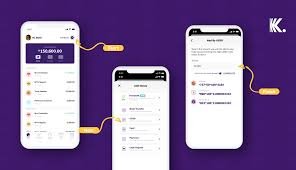

In this article, I will be discussing Opay products and services, Opay fees, Opay registration process, Opay customer support, Opay investment opportunities, Opay reviews, and a lot more about Opay that you need to know.

OPay is a popular mobile payment platform that was launched in August 2018 in Lagos, Nigeria. It was founded by the Chinese company, Opera Software, which is best known for its web browser, Opera.

OPay initially started as a ride-hailing platform but as time goes, it got expanded into other areas such as food delivery, logistics, and mobile money services.

Today, Opay has become one of the leading mobile payment platforms in Nigeria and has expanded its services to other African countries such as Kenya, Egypt, and South Africa.

With Opay, you can get access to a wide range of services which includes mobile money transfers, bill payments, airtime top-ups, and cash withdrawals.

It also has a digital wallet, OWealth, that allows users to save and invest their money.

OPay has received significant investment from various sources, including Sequoia China, SoftBank Ventures Asia, and IDG Capital. In 2020, Opay raised $120 million in a Series B funding round, which was one of the largest funding rounds in Africa at the time.

Opay Products And services

As mentioned earlier, you can get access to a wide range of services offered by Opay, some of these services include the following:

- Mobile Money

- Owealth

- OBus

- OFood

- OCar

- OwealthPlus etc.

Opay Fees

OPay fees vary depending on the service being used. Take for instance, mobile money transfers on OPay are free, while withdrawals from ATMs incur a fee of 60 naira per withdrawal.

Read: Owealth, fixed, target: opay savings review, interest rates, FAQs and more

Fees for other services such as OBus and OFood are dependent on the distance or the value of the order.

OPay also charges a small fee for some financial services such as bill payments and airtime top-up.

Opay Registration Process

The registration process for OPay is simple and straightforward. Kindly follow the following steps to register:

Download the OPay app from Google playstore or the App Store.

Install the app and click on the “Register” button.

Fill in the registration form with your personal details, including your name, phone number, and email address.

Verify your phone number by entering the verification code sent to your phone.

Create a four-digit transaction PIN for your account.

Set up your profile by adding your photo and other necessary details.

Start using OPay’s services, such as mobile money transfers, bill payments, and airtime top-up.

Opay Customer Support

OPay offers several channels through which customers can reach their customer support team for support of any kind that is related to Opay or its services. I’m also using Opay and I can easily figure out most of their support systems. Below are some of the various ways to contact them:

- In-App Chat

- Contact us

- Email service.ng@opay-inc.com

- Opay Facebook Page

- Phone Number 0809-999-9199 or 01-700-6200.

- Physical office etc.

Those are the 6 ways you can get in touch with the Opay customer service team.

Opay Investment Opportunities

OPay offers several investment opportunities through its digital wallet, OWealth, and its investment platform, OWealthPlus.

Below are some of the investment opportunities available on OPay:

Fixed Deposits

OPay offers fixed deposit options with competitive interest rates. As a customer, you can choose a tenure of between 30 and 360 days and earn interest on your deposits.

Mutual Funds

OPay’s investment platform, OWealthPlus, offers mutual funds from reputable fund managers. You can choose from a range of mutual fund options and invest in them through the app.

Treasury Bills

OPay also offers customers the opportunity to invest in treasury bills.

Treasury bills are short-term debt instruments issued by the government, and they offer relatively low-risk investment options with guaranteed returns.

Stocks

OWealthPlus also offers customers the opportunity to invest in stocks listed on the Nigerian Stock Exchange (NSE). You can buy and sell stocks through the app and earn returns on all your investments.

Money Market Funds

OPay also offers customers the opportunity to invest in money market funds, which are investment vehicles that invest in low-risk, short-term securities such as treasury bills, commercial papers, and certificates of deposit.

Opay Reviews

OPay has generally received positive reviews from customers in Nigeria and I can say that is why the company is booming and making progress day by day.

Recommended: Opay Vs M-Pesa: Which Mobile Payment Platform Is Better?

Most people that use or have tried Opay have made positive reviews saying; Opay is fast and reliable, easy to use, has good customer support, opportunity to invest for high returns, etc.

Opay Nigeria

OPay has been positively received by customers in Nigeria, and its services have helped to improve financial inclusion and access to financial services for many Nigerians.

Opay Africa

Opay is a company that is not limited to Nigeria alone, rather it has expanded to other parts of Africa such as Kenya, Egypt, South Africa, etc.

The company is likely to expand more in the nearest future.

Opay Payment, Opay Mobile Money

Opay Payment & Opay Mobile Money

OPay offers a range of payment services, including mobile money, which allows customers to perform financial transactions using their mobile phones. Here are some of the payment services available on OPay:

Opay Mobile Money

OPay’s mobile money service allows customers to send and receive money, pay bills, and buy airtime using their mobile phones.

Customers can also use the service to make withdrawals from their OPay wallets at any OPay agent location or ATM that supports OPay withdrawals.

Opay QR Code Payments

OPay also offers QR code payments, which allow customers to pay for goods and services by scanning a QR code using their OPay app. This service is available at participating merchants, such as supermarkets, restaurants, and other retail outlets.

Opay Bank Transfers

Customers can also use OPay to transfer money from their bank accounts to their OPay wallets or to other bank accounts in Nigeria.

Opay Bill Payments

OPay allows customers to pay for various bills, including electricity bills, cable TV subscriptions, and internet bills, using their OPay wallets.

Opay Point of Sale (POS) Payments

OPay has also launched a point of sale (POS) device that allows merchants to accept payments from customers using their OPay wallets.

This service is available to merchants who register with OPay.

List of Opay Financial Services

OPay offers a wide range of financial services, which makes them to remains one of the tops and leading Fintech companies in Nigeria and the whole of Africa today. Below are some of their services:

- Mobile Money

- QR Code payments

- Bill Payments

- Investment Opportunities Ride-Hailing services

- E-commerce

- POS services etc.

Opay Wallet

Opay Wallet is a digital wallet service offered by the Nigerian-based fintech company OPay.

The service allows users to store and manage their funds digitally, enabling them to make payments, transfer money, and access various financial services without the need for physical cash.

To use Opay Wallet, you’ll need to download the Opay mobile app, which is available for both Android and iOS devices.

Once downloaded, kindly can sign up for an account, verify your identity, and then start using the wallet to make payments, buy airtime and data, pay bills, and access other financial services.

Opay Fees

Opay charges fees for some of its services, but the fees vary depending on the type of service being used. However, below are some examples of the fees charged by Opay:

Opay Money transfer fees

Opay charges a fee for sending money from one Opay wallet to another or from an Opay wallet to a bank account. The fee for this service ranges from 10 Naira to 100 Naira depending on the amount being transferred.

Airtime and Data purchase fees: Opay charges a fee for buying airtime and data through its platform. The fee for this service ranges from 1% to 4% of the transaction amount.

Opay Bill payment fees

Opay charges a fee for paying bills such as electricity, cable TV, and internet subscriptions through its platform. The fee for this service ranges from 20 Naira to 100 Naira depending on the type of bill being paid.

Opay Withdrawal fees

Opay charges a fee for withdrawing cash from an Opay wallet to a bank account. The fee for this service ranges from 20 Naira to 100 Naira depending on the amount being withdrawn.

Opay Login

To log in to your OPay account, follow these steps:

- Open the OPay app on your mobile device.

- Enter your phone number and password in the fields provided.

Click on “Log In” to access your account.

- If you forget your password, you can click on the “Forgot Password” option on the login page to reset your password.

If you encounter any issues or need assistance with your OPay account, you can contact the OPay customer care team using any of their contact platforms I’ve shared with you earlier.

Opay agents

Opay has a network of agents and Point of Sale (POS) devices that provide various financial services to customers.

These agents are located in different parts of Nigeria and are trained to offer services such as cash deposits and withdrawals, airtime and data purchases, bill payments, and more.

To locate an OPay agent near you, follow these steps:

Open the OPay app on your mobile device.

Click on the menu icon in the top-left corner.

Select “Find Agents” from the menu.

Enter your location in the search field or allow the app to access your device’s location.

The app will display a map showing the location of OPay agents near you. You can click on any of the markers on the map to see the name and address of the agent.

However, if you’re also interested in becoming one of their agents kindly read this article, everything you need to know about becoming an agent has been shared there.

Opay POS

Opay POS is a terminal used by agents to carry out transactions. You can also apply to get an Opay POS as an agent.

Opay QR Code

Opay offers a QR code payment system that allows users to pay for goods and services by scanning a QR code with their Opay app. Below is how it works:

Open the Opay app on your mobile device.

Click on the menu icon in the top-left corner.

Select “QR Payment” from the menu.

Scan the QR code displayed at the merchant’s point of sale (POS) terminal using your Opay app.

Enter the amount you want to pay and confirm the transaction.

The merchant will receive the payment instantly, and you will receive a confirmation of the transaction on your Opay app.

Opay News

To always get the latest updates, you can visit the official Opay website or download the Opay app to stay up to date with the latest news, updates, and features.

Also, you can check news websites, social media platforms, and other online sources to stay informed about Opay-related news and events.

Frequently Asked Questions About Opay

Here are some frequently asked questions about Opay:

What services does Opay offer?

Opay offers a range of services, including bill payments, airtime purchases, fund transfers, and investment opportunities.

How do I fund my Opay wallet?

You can fund your Opay wallet using a bank transfer or by depositing cash at an Opay agent.

How do I withdraw money from my Opay wallet?

You can withdraw money from your Opay wallet by visiting an Opay agent and making a withdrawal request. You can also transfer funds to your bank account directly from your Opay wallet.

What fees does Opay charge?

Opay charges fees for some transactions, such as fund transfers and cash withdrawals. The fees vary depending on the type of transaction and the amount involved.

How do I contact Opay customer care?

You can contact Opay customer care by sending an email to help@opay.team or by calling the Opay customer care hotline at 01-700-6200.

Can I use Opay outside Nigeria?

No, Opay is currently only available in Nigeria.

How secure is the Opay app?

Opay uses state-of-the-art security measures to protect its users’ data and transactions, including encryption and two-factor authentication.

However, users are also advised to take their own security measures, such as using strong passwords and not sharing their login details with others.

How do I become an Opay agent?

You can become an Opay agent by contacting Opay customer care or visiting the Opay website and following the registration process.