I Need A Loan Of 50000 Naira (How Do I Get It?)

I’ve you been asking yourself I need a loan of 50000 naira, how do I get it or have someone around you asking I need a loan of 50000 naira.

The solution is here already, I have extensively provided some loan apps that could get you a loan up to 50000. These loans are fast but not just fast they’re almost instant.

The process of getting a loan from any commercial bank in Nigeria may take from a week to a month but with the list of apps I’m going to share with you, you shall get the loan almost instantly provided all requirements are met.

Still want to know and asking “I need a loan of 50000 naira which apps is the best when it comes to flexibility and competitve interest rates?

The answer needed to this as being provided in this same article.

All you have to do is to take your time and read.

I need a Loan of 50000 naira how do I get it?

Below are the answers to the question “I need a loan of 50000 naira”.

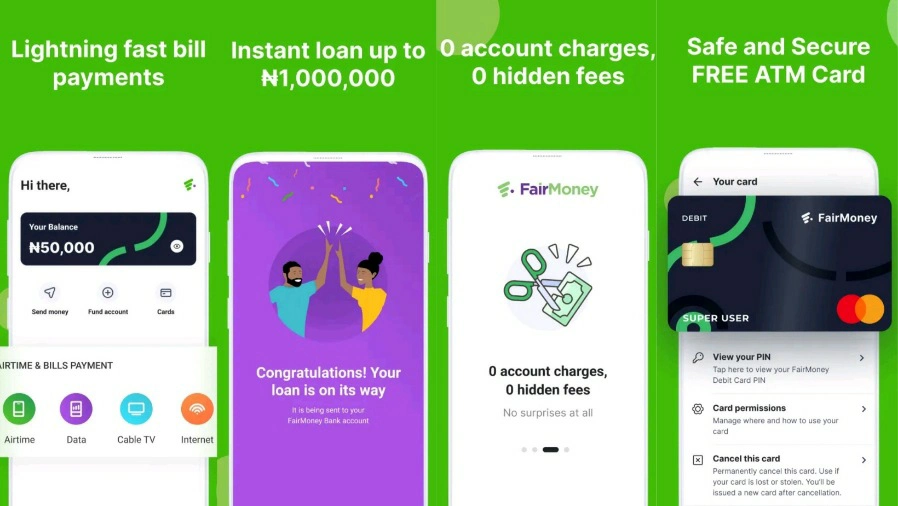

1. FairMoney

One of the apps that can provide the right solution to your question (I need a loan of 50000 naira” is Fairmoney loan app.

Read: How To Become Palmpay Aggregator And Palmpay Agent

One of the most reliable loan apps you can always use to get your instant or almost instant loan is Fairmoney.

With this app, getting a loan of 50,000 is very possible.

However, it’s important you have it in mind that there are some requirements that you must meet before you finally access the loan.

If unfortunately your loan request gets disapproved, you may try again and or try another app entirely.

2. Okash

Another app that can provide a solution to the question (I need a loan of 50000 naira) is Okash.

Okash is nothing but one of the very best loan applications you can see today.

Okash is one of the main features you can find on the Opay app, although, they also have a separate app that can be downloaded right from the Google Play Store.

One of the reasons that could make you choose Okash is the fact that they run the loan business like a professional business, unlike some app owners who harass their customers when there’s a late repayment.

As an Okash user, you can get a loan of 50000 naira needed inasmuch the requirements have been met.

Read Also: Loans For Unemployed People In Nigeria (2023)

For you to quickly apply for a loan with Okash, please download the Okash app from the Google Play Store, sign up with every required detail, and apply for the needed loan.

3. Aella Credit

Aella Credit is a tested and trusted financial loan app likewise one of the very best loan apps in the country today.

With this app, users can get a loan that ranges from as low as N3,000 up to a million naira without collateral or any paperwork.

With Aella Credit, you’ll enjoy a competitive interest rate that ranges between 4-29% monthly, this will depend on the amount of loan borrowed from the app.

Earlier, I said the Aella Credit loan app is tested and trusted, and yes it is, I have tried the app two times and see their service is superb.

4. Carbon (Paylater)

Paylater loan app’s new name is Carbon. Carbon is one of the oldest loan apps in Nigeria.

With Carbon loan app and as a user you can easily get a loan of 50000 naira you need just by meeting their flexible requirements.

When it comes to the quickness of getting a loan from Carbon, it can never be compared to that of commercial banks.

However, for you to assess a loan of 50000 naira or more, you will be required to download the app from Play Store or any reputable source.

Once downloaded and installed, open and create an account with a strong but easily remembered password to prevent a third party from accessing your account.

After creating an account, proceed to apply for a loan which typically takes 24 hours or less.

5. Renmoney

This article is incomplete if renmoney loan app is not included in the list of apps that give instant loans without collateral to their esteemed customers.

The primary focus of renmoney is lending loans to borrowers in need of money instantly and can meet their loan requirements such as being at least 18 years of age, providing two guarantors contacts, providing your Bank Verification Number (BVN), and other few requirements.

Once you are ready to take a loan from the renmoney loan app, kindly head over to Play Store (for android users) and apple store for (iPhone users).

You May Like: Loans Without ATM Card: How To Get It

Download the app, sign up, and apply immediately. After review, and your loan is approved, you will get the loan disbursement in your account in less than 24 hours.

Please, ensure you make repayment as earlier as possible to increase your credit scores, the advantage of doing this is to get a chance to borrow more money.

Frequently Asked Questions On “I Need A Loan Of 50000 Naira

The following are the related questions to I need a loan of 50000 naira you should know:

What are the requirements to get a loan of 50,000 Naira?

The requirements to get a loan of 50,000 Naira may vary depending on the lender but usually include proof of identification, proof of income, and a good credit score.

Can I get a loan of 50,000 Naira without collateral?

Yes, some lenders offer unsecured loans, which do not require collateral.

However, these loans often have higher interest rates than secured loans.

How long does it take to get a loan of 50,000 Naira?

The time it takes to get a loan of 50,000 Naira may vary depending on the lender and the application process.

Some lenders may offer same-day funding, while others may take several days or weeks to process the loan.

What is the interest rate on a loan of 50,000 Naira?

The interest rate on a loan of 50,000 Naira may vary depending on the lender and the type of loan. Generally, unsecured loans have higher interest rates than secured loans.

What happens if I cannot repay the loan of 50000 Naira?

If you cannot repay the loan of 50,000 Naira, the lender may charge late fees or penalties and report the delinquent payment to credit bureaus.

This could negatively impact your credit score and make it more difficult to obtain credit in the future. In some cases, the lender may take legal action to collect the debt or seize the collateral if the loan is secured.