EaseMoni Loan – EaseMoni USSD Code, Interest Rate, Loan Repayment and How To Borrow Money From EaseMoni

EaseMoni is a Nigerian fintech company that offers financial solutions such as loans, savings, and investment options to individuals and businesses. EaseMoni provides its services through a mobile app, which can be downloaded from the Google Play Store. Some of the features of the app include quick loan disbursement, easy account opening, savings options, investment opportunities, and bill payments. Customers can also make transactions, such as fund transfers and airtime purchases, through the app. EaseMoni is known for its fast and convenient loan application process, which can be completed within minutes. The company offers different loan options to suit the needs of its customers, including short-term loans, salary advance loans, and business loans. However, in this post, you will explore the following: about EaseMoni loan, what is EaseMoni USSD Code?, EaseMoni loan interest rate, EaseMoni loan repayment and others which are deemed to be made known.

What is EaseMoni Loan?

As mentioned earlier, EaseMoni is a Fintech company in Nigeria that offers financial solutions such as loans and a lot more.

I paused here and don’t mind talking about other services the company provides because this article is based on the EaseMoni loan.

Things such as the EaseMoni USSD Code?, EaseMoni loan interest rate, EaseMoni loan repayment, and borrowable amount have been shared quite below:

EaseMoni USSD code

EaseMoni ussd code is a code that can be used to access EaseMoni or transacts on EaseMoni without the need to visit or log in to the app. This same code can be used in accessing the EaseMoni loan, get approved, and get it disbursed to the designated bank account within 24 hours.

What is the EaseMoni ussd code?

The EaseMoni ussd code is *347*334#.

As I’ve mentioned earlier you can use it to carry out different kinds of transactions on EaseMoni.

How much can EaseMoni borrow me?

The amount of money that EaseMoni can lend you may vary depending on several factors, such as your creditworthiness, income, loan repayment history, and the type of loan you are applying for. EaseMoni offers various loan options, including short-term loans, salary advance loans, and business loans.

The loan amounts and repayment terms may differ for each loan option. For instance, salary advance loans typically offer a percentage of your monthly salary, while short-term loans may have a fixed amount that you can borrow.

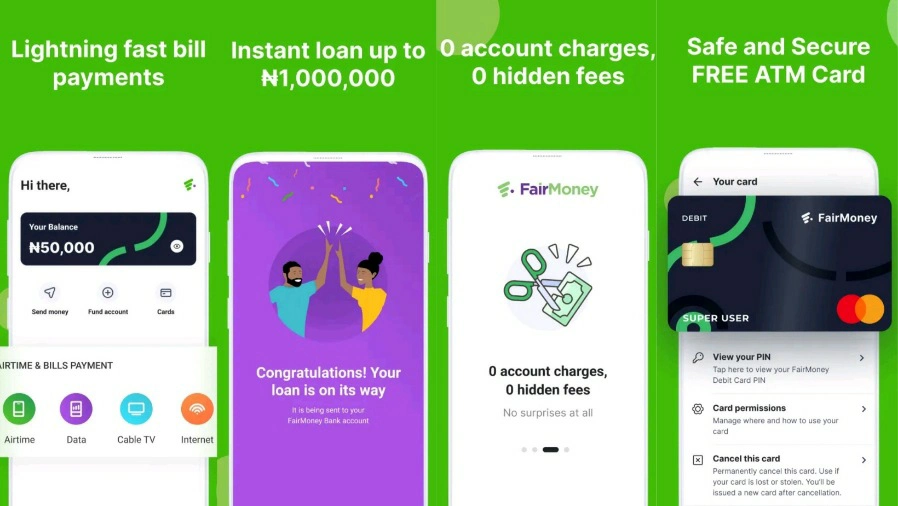

Related: Fairmoney vs Renmoney and Palmpay; Which is the best Loan App?

The amount of money you can borrow from EaseMoni ranges from N3,000 to as much as N1,000,000.

With that being said, you need to understand that the minimum loan amount you can get as a new customer may vary and depends on different factors e.g. your credit score.

However, I’ll implore you to find out how much money you can borrow from EaseMoni, you can download their mobile app or visit their website to start the loan application process.

You will need to provide some basic information about yourself, such as your employment status, income, and personal details, and the app will determine your eligibility and the amount of money you can borrow.

EaseMoni loan requirements

EaseMoni loan app has some requirements you must meet before you finally get a loan, some of them are the following:

Valid identification: You will need to provide a valid form of identification, such as a national ID card, driver’s license, or international passport.

Proof of income: You will need to provide proof of your income, such as bank statements, payslips, or tax returns.

Bank account: You will need to have an active bank account where the loan funds can be deposited and repayments can be deducted.

Employment status: You may need to be employed or have a steady source of income to be eligible for some loan options.

Age: You must be at least 18 years old to be eligible for a loan from EaseMoni.

EaseMoni loan interest rate

Generally, EaseMoni is known for its competitive interest rates, which are lower than those offered by many traditional banks and lending institutions.

The interest rates may range from 5 to 10%, depending on the loan option and your eligibility.

EaseMoni loan repayment

EaseMoni offers various repayment options for their loans, depending on the loan option and your preference.

Some of the common repayment options include:

Read Also: Top Loan Apps In Nigeria To Get A Quick Loan Without Collateral In 2023

Direct debit: EaseMoni can deduct the loan repayment amount directly from your bank account on the due date.

This option ensures that you don’t miss any payments and helps you avoid late fees.

Mobile app: You can also make loan repayments using the EaseMoni mobile app. The app allows you to easily check your outstanding loan balance, make repayments, and monitor your repayment history.

Bank transfer: You can also make repayments through bank transfers using the provided bank account details. Ensure you include your loan account number as the payment reference to facilitate easy allocation of your payment to your loan account.

Post-dated cheques: You can also use post-dated cheques to repay your loan. This option is suitable if you prefer to make payments in advance or if you have limited access to electronic payment methods.

How to borrow Money from EaseMoni

To borrow money from the EaseMoni loan app, follow the steps below:

Download the EaseMoni mobile app from the Google Play Store or Apple App Store.

Register for an account on the app using your phone number and other personal information.

Complete the app’s Know Your Customer (KYC) process, which involves submitting your BVN (Bank Verification Number) and other personal information.

Once your account is verified, you can apply for a loan by selecting the loan option on the app’s dashboard and providing the required information, such as loan amount and repayment period.

The app will then calculate your loan eligibility and interest rate based on your creditworthiness and repayment history.

If you agree with the terms and conditions of the loan, you can proceed to submit your loan application.

Once your loan application is approved, the funds will be disbursed to your bank account.

Frequently Asked Questions On EaseMoni loan, Ussd code, requirements

Below are essential frequently asked questions you may need answers to:

Is EaseMoni a good loan app?

EaseMoni loan app can actually be a good one for people looking for quick and easy access to loans. The app offers flexible repayment terms and competitive interest rates, making it a convenient option for those in need of emergency cash.

What is the highest loan amount for EaseMoni?

EaseMoni offers loans ranging from N3,000 to N1,000,000 to eligible customers. The loan amount you can qualify for depends on your creditworthiness, repayment history, and other factors.

How to get a loan on EaseMoni?

To get a loan on EaseMoni, you need to download the app from the Google Play Store or Apple App Store and register for an account follow every step explained earlier in “how to borrow money from EaseMoni” specified above.

Which loan app gives 50000 instantly?

There are several loan apps that offer instant loans up to N50,000 in Nigeria, including EaseMoni, Carbon, Branch, FairMoney, and KiaKia.

However, the loan amount you can qualify for and the interest rates and fees vary depending on your creditworthiness and other factors. It’s important to compare different loan apps and carefully review the terms and conditions before applying for a loan to ensure you can comfortably meet the repayment terms.