Best Loan Apps in Nigeria for Students

Are you a student in Nigeria looking for quick and convenient access to loans? Look no further! In this article, you will explore the list of the best loan apps in Nigeria for students.

These apps provide a hassle-free way to secure loans, manage finances, and meet your financial needs with ease.

Let’s dive into the top loan apps in Nigeria for students.

List of the Best Loan Apps in Nigeria for Students 2023

Below are the best loan apps for Nigerian students we’re talking about:

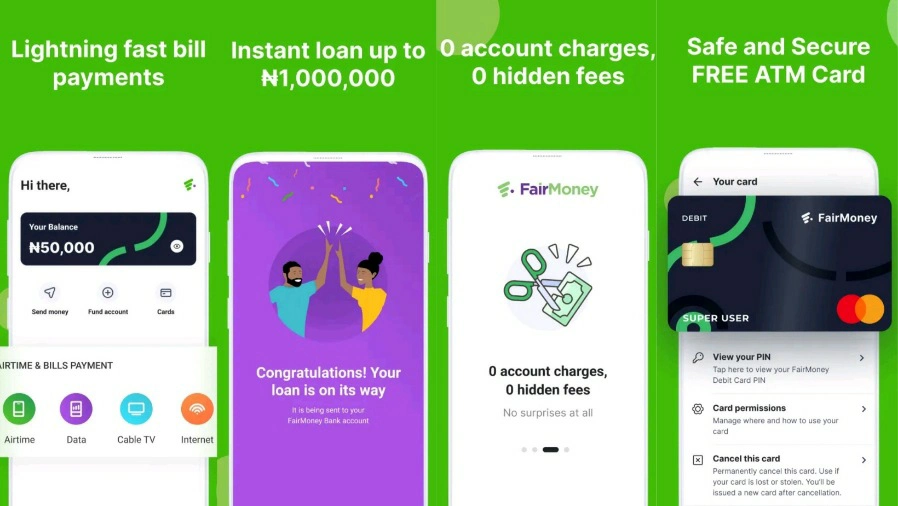

Fairmoney

Fairmoney is undoubtedly one of the greatest and best loan apps in Nigeria for students in 2023.

With a simple user interface and a wide range of features, it offers a seamless experience for loan applications, bill payments, and mobile recharges.

One of the standout features of Fairmoney is its low-interest rates, making it an affordable option for students.

However, to be eligible for a loan with Fairmoney, you must have the Fairmoney MFB app installed on your Android smartphone, a supported bank account, and a valid Bank Verification Number (BVN).

Also, you need to be at least 18 years old, a Nigerian citizen, and possess a good credit history.

The loan duration can range from 30 days to 12 months, with interest rates varying between 10% and 30%.

Carbon

Carbon is also known as one of the best loan apps in Nigeria for students, it provides quick and easy access to loans.

Carbon stands out for its convenience and simplicity.

Read: Best Banks for POS Business in Nigeria

For you to get a loan from Carbon as a student, it’s essential for you to already get the app installed on your Android or iOS phone.

These loan apps usually have similar loan requirements e.g. borrowers must be at least 18 years and sometimes up to 65 years of age, borrowers must have a bank account and be willing to provide his/her BVN, the borrower must possess a good credit score, etc.

The loan term for Carbon loan app ranges from 2 weeks to 90 days depending on the borrowed amount.

Branch

Branch is a popular loan app that caters not only to Nigerian students but also to borrowers in neighboring countries like Kenya, Mexico, and India.

With Branch, you can apply for loans and receive funds directly in your bank account within minutes.

The quick and reliable service offered by Branch makes it an ideal choice for students in need of immediate financial assistance.

To be eligible for a loan with Branch, you must have the Branch app installed on your Android smartphone. Additionally, you need to be at least 18 years old, a Nigerian citizen, and possess a good credit history.

Aella Credit

Aella Credit is a loan app specifically designed for students who are at least 18 years old and have a source of income.

With its intuitive interface and repayment terms of up to 60 days, Aella Credit provides students with a convenient way to access loans and manage their finances effectively.

To apply for a loan with Aella Credit, you need to have the Aella app installed on your Android smartphone.

Related: Instant Loan in Nigeria – Which App Gives Loan Immediately in Nigeria?

Also, you must be a Nigerian citizen and possess a good credit history.

The interest rates for Aella Credit loans range from 6% to 29%.

PalmCredit

When it comes to loan programs in Nigeria, PalmCredit is a leading choice for many individuals and SMEs

With PalmCredit, students can borrow amounts ranging from as low as N2,000 to N100,000 within just a few minutes provided they meet the requirements.

For students to be eligible for a loan on palmcredit, they need to download the app, sign up, fill in the necessary details, and ensure they meet all the requirements.

Renmoney

Renmoney is a reputable financial institution that provides its users with flexible and reliable loan offers.

With Renmoney, you as a student, individual or business can borrow a loan up to the sum of N6,000,000 with flexible repayment options.

The application process is quick and straightforward, and funds are disbursed within 24 hours upon approval so far you meet the requirements.

This bank also remains one of the best loan apps in Nigeria for students in 2023.

KwikMoney

KwikMoney, now known as Migo, is a popular loan app in Nigeria and one of the best loan apps in Nigeria for students, individuals, and SMEs.

With KwikMoney, you can borrow an amount of money that ranges from as low as N500 to N500,000 with flexible repayment.

Note: The amount of money you will get will solely depend on your creditworthiness.

Certain requirements also need to be met for you to successfully get a loan from them.

QuickCheck

Quickcheck loan app is also not left out of the list of best loan apps for students in Nigeria today.

It is a loan app that offers fast and convenient loans to students and individuals in Nigeria.

With this QuickCheck loan app, anyone who is within the age range of 18 to 65 can apply for a loan that ranges from N1,500 to N500,000 without requesting any collateral.

You may be eligible in your first trial but if not, you can still reapply on any reassigned date given to you and get approved. l just within minutes and the loan will be disbursed to the designated bank account.

Sokoloan

Sokoloan is a reliable loan app in Nigeria that offers instant cash loans to students and individuals.

With the Sokoloan app, you can access loans ranging from N5,000 to N100,000 with flexible repayment options.

The loan application process is simple, and funds are disbursed directly to your bank account.

To apply for a loan with Sokoloan, you need to have the Sokoloan app installed on your Android smartphone.

You also need to be at least 18 years old, a Nigerian citizen, and have a bank account, be willing to provide your bank verification number (BVN).

C24

C24 is a loan app that provides personalized loans to students and individuals in Nigeria.

With C24, you can access loans ranging from N20,000 to N5,000,000 with flexible repayment terms. The application process is straightforward, and funds are disbursed within 24 hours upon approval.

To be eligible for a loan with C24, you need to be at least 18 years old, a Nigerian citizen, have a steady source of income and possess a valid means of identification.

FAQs on best loan apps for students in Nigeria

How much can students borrow through these loan apps?

The loan amounts available to students through these loan apps depend.

It usually depends on factors such as the student’s creditworthiness, repayment history, and the specific loan app’s policies. Generally, loan amounts can range from a few thousand Naira to several hundred thousand Naira.

What interest rates do loan apps charge?

The interest rates charged by loan apps for students depend. I’ll recommend you carefully review the terms and conditions of each app to understand the applicable interest rates and any additional fees.

Interest rates are usually stated as an annual percentage rate (APR) and can range from 10% to 30% or more, depending on the app and the borrower’s creditworthiness.

How quickly can students get the loan amount disbursed?

Loan app disbursement times can vary, but many of these apps strive to provide quick and instant loans. Depending on the app and the borrower’s eligibility, loan amounts can be disbursed within minutes to a few hours after approval.