Best Loan Apps for iPhone Users in Nigeria (2023)

When it comes to obtaining loans in Nigeria, iPhone users have a range of options available at their fingertips. With the increasing popularity of mobile applications, borrowing money has become easier than ever before. In this article, you’ll explore the best loan apps for iPhone users in Nigeria.

These apps offer convenience, quick processing, and flexible repayment options, making them the go-to choice for those in need of immediate funds.

List of The Best Loan Apps for iPhone Users in Nigeria In 2023

Here are the best loan apps for iPhone users in Nigeria today:

Carbon (Formerly Paylater)

Formerly known as Paylater, Carbon is undoubtedly one of the best loan apps for iPhone users in Nigeria.

With its sleek and user-friendly interface, this app provides a hassle-free borrowing experience.

The application process is straightforward, and you can apply for a loan anytime, day or night.

By providing just a few essential details, you can check the status of your loan application within minutes.

Carbon loan app goes beyond offering loans and allows users to make utility bill payments and purchase recharge cards. To get started with Carbon, simply download the app from the official Google Play or iOS store.

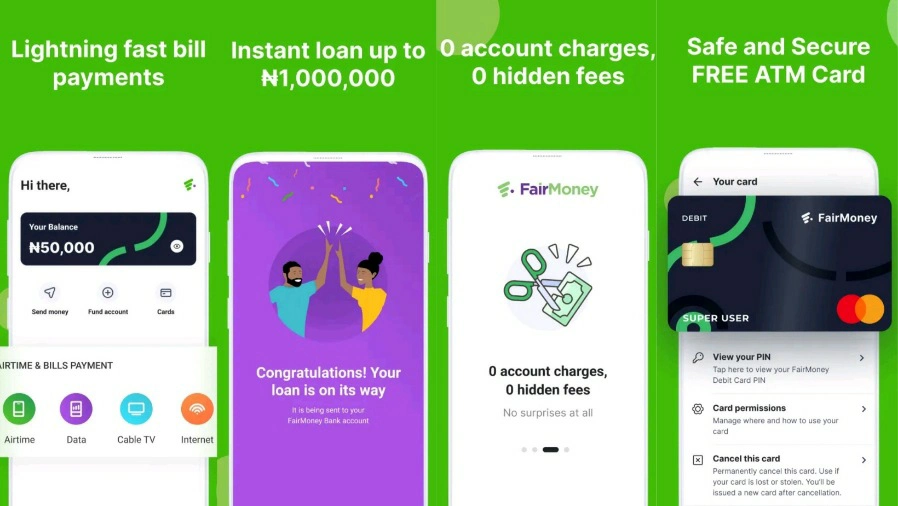

FairMoney

FairMoney is another loan app that is one of the best loan apps for iPhone users in Nigeria in 2023.

With FairMoney, you can obtain a loan without collateral or excessive paperwork.

The repayment period ranges from 15 days to a month, providing flexibility to borrowers.

FairMoney also enables users to pay utility bills conveniently.

The app ensures round-the-clock availability, allowing you to access loans whenever the need arises.

PalmCredit

PalmCredit offers loans ranging from as low as N2,000 to as high as N100,000, catering to a wide range of financial needs. The loan application process is quick and straightforward, requiring only a few simple steps.

Read: Best Loan Apps in Nigeria for Students

However, to qualify for a PalmCredit loan, you must be at least 18 years old and provide your bank account details.

Additionally, the app provides customers with commissions for referring new users, making it an attractive choice for both borrowers and affiliates.

It is also amongst the best loan apps for iPhone users in Nigeria today.

Aella Credit

Aella Credit stands out among the list of best loan apps for iPhone users in Nigeria due to its zero fees on late payments.

This app offers varying interest rates and provides a repayment tenor between 30 and 60 days.

As an added incentive, borrowers who repay their loans before the deadline gain access to higher loan amounts.

Aella Credit ensures a seamless borrowing experience while encouraging timely repayments.

QuickCheck

Quickcheck loan app is also founded amongst the best loan apps for iPhone users in Nigeria.

The app is specifically designed for individuals in need of emergency funds, QuickCheck offers loans to iPhone users in Nigeria.

As of now, the app provides loans up to N30,000 with a repayment tenor ranging from 15 to 30 days.

By making timely repayments, borrowers can increase their maximum loan amount, ensuring greater accessibility to funds.

Renmoney

Renmoney is a popular loan app and is never left out of the list of best loan apps for iPhone users in Nigeria that offer loans without collateral.

Read: Best Loan Apps in Nigeria for Students

It provides quick and convenient access to funds up to N6,000,000 for personal and business purposes.

With a user-friendly interface, Renmoney ensures a seamless borrowing experience for iPhone users. The app offers competitive interest rates and flexible repayment options, making it a reliable choice for individuals in need of financial assistance.

Page Financials

Page Financials is a reputable loan app that provides fast and secure loans to iPhone users in Nigeria.

Whether you require funds for emergencies, education, or personal projects, Page Financials offers a range of loan options tailored to meet your specific needs. The app boasts a simple application process and swift loan disbursement, allowing you to access funds in a timely manner.

Lidya

Lidya is an innovative loan app that caters to small and medium-sized businesses in Nigeria.

The app offers quick loans to entrepreneurs and business owners, enabling them to fund their ventures and expand their operations.

Lidya’s user-friendly interface and efficient loan processing make it a valuable resource for iPhone users seeking financial support for their business endeavors.

Kiakia

Kiakia is a loan app that provides individuals and businesses with quick and convenient access to funds.

With its advanced risk assessment algorithms, Kiakia offers competitive interest rates and personalized loan offers. The app ensures a hassle-free borrowing process for iPhone users, making it a reliable option for those seeking financial assistance.

OneFi Loan App

The OneFi Loan App offers personal and business loans to iPhone users in Nigeria. With a focus on financial inclusion, OneFi provides loans without collateral or extensive paperwork.

The app features a simple and intuitive interface, making it easy for users to navigate through the loan application process and access funds swiftly.

FAQs On Best Loan Apps For IPhone Users In Nigeria

Below are some frequently asked questions on the topic with answers:

How long does it take to receive the loan funds?

The loan processing time varies depending on the app and the specific circumstances.

However, in many cases, these loan apps pride themselves on quick loan disbursement, often providing funds within minutes or a few hours of approval.

However, factors such as the completeness and accuracy of the information provided, the loan amount, and the borrower’s bank processing times may affect the overall processing duration.

What happens if I am unable to repay the loan on time?

If you find yourself unable to repay the loan on time, it is important to contact the loan app’s customer support immediately.

Ignoring repayment obligations can lead to penalties, and additional fees, and negatively impact your credit score.

Some loan apps may offer flexible repayment options or loan extensions, while others may have specific procedures in place for handling late or missed payments.

It’s crucial to communicate with the app’s support team to discuss possible solutions and avoid any adverse consequences.

Can I access loan apps if I don’t own an iPhone?

Yes, most of these loan apps are available for Android devices as well, in addition to being compatible with iPhones.

You can find them on the Google Play Store or the iOS App Store, depending on your device’s operating system.

Ensure that your device meets the minimum requirements specified by the app to ensure compatibility and smooth operation.