Palmpay Review: Is Palmpay Legit?

In this Palmpay review, I’ll be providing an answer to the burning question amongst Nigerians which is is Palmpay legit?

Not limited to that, you will also have an awareness of the benefits, features, and legitimacy to ensure you make the necessary decision.

Without much Ado, let’s delve in right now.

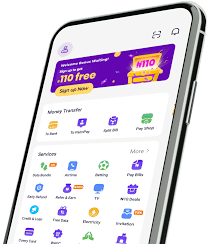

Features of Palmpay

Sending and Receiving Money: Palmpay allows you to send money seamlessly across Nigeria, with minimal charges compared to traditional bank transfers.

VTU Services: Purchase airtime and data, and conveniently pay bills using Palmpay. Enjoy discounts on these services, making your transactions even more cost-effective.

Affiliate Opportunity: Palmpay’s PalmForce program rewards you for referring friends and engaging in transactions.

This incentivizes active usage and customer loyalty.

Free Bank Transfer: Palmpay allows its users to seamlessly carry out transactions from within the app to other banks.

Each PayPal user can transfer 3 times a day without charges.

You will only be charged a transaction fee if you have already exhausted your daily free transfer.

Palmpay Benefits

Palmpay is more than just a payment app; it’s a rewarding experience.

Simplifying cash transfers, bill payments, and airtime purchases, Palmpay also offers an intriguing incentive system.

As you conduct transactions, you accumulate PalmPoints, which can be used to enjoy discounted transactions.

Below are more advanced benefits of using Palmpay.

Bonus on Bills Payment: Palmpay offers a 5% bonus in the form of PalmPoints on bills payments, including electricity and cables.

Bonus on Top-ups: Enjoy a weekly bonus of 100 Naira in PalmPoints when you top up your Palmpay wallet with 1000 Naira.

Invite and Earn: By inviting friends to join Palmpay using your referral code, you earn 300 Naira. Your referrals also receive 500 points upon registration.

Read: Moniepoint Review: Is Moniepoint Legit, Is Moniepoint Legit Or Scam?

Zero account maintenance fees: The number one benefit of using the Palmpay Bank app is that Palmpay Bank does not charge any account maintenance fees, making it an affordable option for banking.

Instant account opening: With Palmpay, you can open an account instantly and start banking right away.

No minimum deposit: Palmpay does not require any minimum deposit, so you can start banking with any amount of money.

Palmpay Review: Is Palmpay Legit?

I’ve been using Palmpay for a while now, and I must say, it’s been a game-changer in the world of mobile payment apps.

The first thing that struck me was its user-friendly interface compared to other financial apps.

Navigating through the app is a breeze, and even if you’re not tech-savvy, you’ll find it easy to use.

One of the standout features for me is the convenience it offers.

With Palmpay, I can pay bills, top up my mobile credit, and even transfer money to friends and family with just a few taps on my phone.

I must confess, that it saves me countless trips to the bank and has made managing my finances a lot simpler.

I know that is not enough reason to show you the legitimacy of Palmpay or all the answers you need to your question “Is Palmpay legit” but keep on reading.

In terms of security, I could say Palmpay is top-notch.

Security is a top priority for me when it comes to payment apps, and Palmpay doesn’t disappoint.

They use robust encryption and authentication methods to keep my personal and financial information safe. Plus, they have a responsive customer support team that’s always ready to help if you encounter any issues.

One thing to prove the legitimacy of Palmpay is the CBN approval.

Palmpay is a CBN-approved mobile payment platform.

It was a popular mobile payment service primarily operating in Nigeria and some other African countries.

Just like Opay, Palmpay also has mixed reactions from users but has more than 4 of the 5 ratings on the Google Play Store and Apple App Store.

FAQs On Palmpay Review: Is Palmpay Legit Or Scam?

I have provided a list of some frequently asked questions related to Palmpay review, Is Palmpay legit or a scam? with answers:

Is PalmPay trusted?

Yes, PalmPay is considered a trusted financial platform.

It has gained credibility for its user-friendly interface, robust customer support, and stringent data protection measures.

Is PalmPay good to use?

Absolutely, PalmPay is a good choice for handling financial transactions.

With its easy-to-use interface, diverse features, and enticing reward system, it provides a seamless and rewarding experience for users.

Is PalmPay a safe bank?

PalmPay isn’t a bank; it’s a fintech platform that offers payment services.

While it’s not a traditional bank, it does prioritize security.

Your data is encrypted, and the app is designed to ensure safe transactions. However, it’s always recommended to follow best practices for online security.

What is the disadvantage of the PalmPay app?

One potential disadvantage of the PalmPay app is that occasional bugs may arise, as with any software.

While these bugs are typically minor and don’t disrupt the overall functionality, they can occasionally lead to temporary inconveniences for users.

Which bank owns PalmPay in Nigeria?

PalmPay is not owned by a bank.

It’s a standalone fintech platform that focuses on digital payments, money transfers, and bill payments.

It collaborates with financial institutions to facilitate transactions but is not directly owned by any particular bank.

Is PalmPay better than OPay?

The choice between PalmPay and OPay depends on your individual preferences and needs.

Both platforms offer similar services, but they may have different features and rewards.

It’s a good idea to compare the specific offerings of each platform to determine which one aligns better with your requirements.