How to trade on Solana using bonfida Dex Aggregator (the most effective dex on Solana)

Solana is still going strong after last year outburst, it’s still delivering on its mission of being the blockchain with the fastest transaction confirmation time, low cost of transaction and high transaction throughput.

Since it’s inception, many DEX have been built on it, while some are very good, some have remain stagnant and mediocre and sometimes very ineffective in the trading facilities provided.

Here I’m introducing bonfida dex Aggregator, if somehow you are new to the Solana ecosystem, you may be asking which is the best dex on Solana? I will answer that question now along with some problems that bonfida dex Aggregator solves while swapping your tokens.

Read also: When will Wakanda Inu reach 1 Naira

Problem 1: Solana transaction byte size limit

Have you tried to swap tokens before and it pop’s up an error that price must be in increment of 1. i.e 1,2,3 or 0.1, 0.2, 0.3.

Bonfida solves this problem of price must be in increment of 1 perfectly, you can swap coins with decimals such as 0.15 , 0.22 e.t.c

Problem 2: Low number of coins & tokens

Another problem most DEXes on Solana have is the small number of tokens usually listed, reason for this is because a market have not been created for that particular token. In simpler terms, there’s no liquidity for the token to be traded.

Bonfida dex Aggregator here, being an Aggregator, has an ernomous amount of tokens listed and you’ll more often than not find the token you’re looking for.

problem 3: complex and slow user interface

Some DEXes have complicated user interface, and not only are they complicated they’re also slow, you have to wait for some seconds for what you click to take action.

This can be very frustrating for users, with the nature of cryptocurrency time is very important, you may not get the same rate if the asset drops in value.

Problem 4: low price, due to slippage

Bonfida aggregates liquidity from several platforms, with this the liquidity will always remain high, high volume of liquidity means higher rates. likelihood for a transaction to fail is also reduced.

How to trade on Bonfida dex Aggregator

1. firstly visit bonfida https://dex.bonfida.org

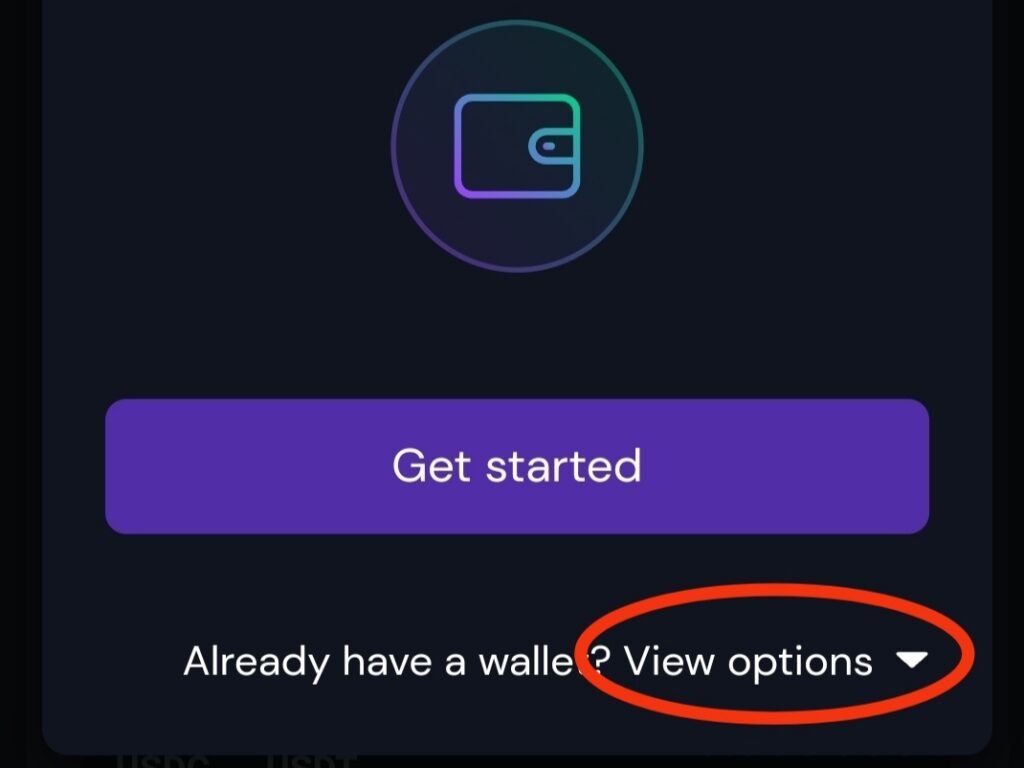

2. Connect your wallet, to connect your wallet click on connect wallet, then click on view options, select the wallet you’re using and connect

3. Select your asset at the first drop-down menu and select the token you want to swap to on the second drop-down menu

4. input the quantity you wish you swap and click on swap it will execute your trade instantly.

Definition of terms

- DEX: this stands for decentralized exchange, it’s a kind of exchange that doesn’t require intermidiaries, i.e no middle man. Transactions are carried out by Smart contracts.

- AGGREGATOR: Dex Aggregator is a platform that source liquidity from different exchanges, then also provide a means for users to have access to this liquidity on a single dashboard.

- Liquidity pool: Liquidity pool is a smart contract enabled Market on a Dex, that allows assets to be exchanged for one another.

- Slippage: This is the difference between the expected price and the price gotten after a swap. Reasons for this difference can be a price increase or price drop or an insufficient liquidity for a large trade.