Best Currency Pairs to Make More Profit in Forex without Losing so Much

Best Currency Pairs to Make More Profit in Forex without Losing so Much

Forex trading is known as the art of buying and selling currencies to profit from their values, and is a thrilling endeavor. Yet, it’s also a way where fortunes can be made or lost in the blink of an eye.

However, since the case seems like a game where one can either lose or win , you need to choose the right currency pairs to make more profit in forex while losing so much to forex.

I have taken my time to provide you with a guide which outlines the best currency Pairs to make more profit in forex without losing so much in 2023.

What are the best currency Pairs to make more profit in forex without losing so much?

You can only find them if you continue reading!

Best Currency Pairs to Make More Profit in Forex without Losing so Much

Want to know the best currency pairs that have the potential to help you make more profit in forex without exposing yourself to excessive risk? If affirm, below are what you need to know:

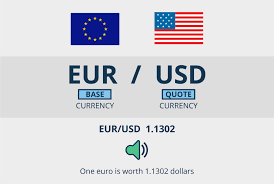

EUR/USD (Euro/US Dollar)

The EUR/USD pair is often referred to as the “Eurodollar” and is renowned for being the most traded currency pair globally.

This popularity is primarily due to its high liquidity and relatively low spreads.

The Eurozone and the United States represent two of the largest economies globally, offering greater opportunities for traders.

The pair is very sensitive to geopolitical events, making it crucial to stay informed about economic developments in these regions.

USD/JPY (US Dollar/Japanese Yen)

The USD/JPY pair is favored to provide you with a guide which outlines the best currency pairs to make more profit in forex without losing so much primarily because of its stability and reliability.

Japan serves as a major financial hub in Asia, while the USD is the world’s primary reserve currency.

Read: Is Forex and Crypto Trading a Good Business to do Online and Make Money from It Fast and Easy?

This pair offers consistent trading opportunities, but traders should monitor economic indicators and central bank policies in both countries.

GBP/USD (British Pound/US Dollar)

This is widely known as the “Cable,” the GBP/USD pair is highly liquid and often experiences strong trends.

It’s quite important for you to stay updated on Brexit-related news and economic developments in the UK and the US when trading this pair.

You need to always keep an eye on central bank policies, economic data releases, and political events that can provide valuable insights for your trading strategy.

AUD/USD (Australian Dollar/US Dollar)

The AUD/USD pair is known as the “Aussie.” Australia’s strong ties to the Asia-Pacific region and its commodity driven economy can influence this pair’s movements.

Traders should pay attention to factors like commodity prices, the Reserve Bank of Australia’s policies, and US economic indicators.

USD/CAD (US Dollar/Canadian Dollar)

The USD/CAD pair provides you with a guide which outlines the best currency Pairs to make more profit in forex without losing so much in 2023.

Oftentimes, it is referred to as the “Loonie,” it is influenced by oil prices due to Canada’s significant oil exports. Also, economic data from both countries and changes in interest rates play a crucial role in its fluctuations.

FAQs On Best Currency Pairs to Make More Profit in Forex without Losing so Much

Here are some helpful frequently asked questions related to Best Currency Pairs to Make More Profit in Forex without Losing so Much with answers:

Which forex pair is most profitable?

Truth be told, there’s definitely no one-size-fits-all answer to this question as the profitability of a forex pair depends on various factors, including market conditions, your trading strategy, and risk tolerance.

Generally, major currency pairs like EUR/USD, GBP/USD, and USD/JPY are popular choices due to their liquidity and relatively stable price movements. However, profitability ultimately depends on your trading skills and how well you adapt to market conditions.

How to make money in forex without losing?

Making money in forex without losing is a challenging endeavor, but it’s possible with the right approach. Here are some key tips:

Develop a solid trading strategy: Use technical and fundamental analysis to make informed decisions.

Practice risk management: Set stop loss orders to limit potential losses and avoid over leveraging.

Educate yourself: Continuously learn about forex markets and trading techniques.

Start with a demo account: Practice trading with virtual money before risking real capital.

Keep emotions in check: Avoid impulsive decisions and stick to your trading plan.

Which currency pairs move the most pips?

Currency pairs with higher volatility tend to move the most pips.

Pairs involving currencies from emerging markets, such as USD/TRY (US Dollar/Turkish Lira) or EUR/ZAR (Euro/South African Rand), often exhibit significant price swings.

Major pairs like GBP/USD and AUD/USD can also experience substantial pip movements during news events or economic releases.

What currency pair is best to trade?

The best currency pair to trade depends on your trading style, risk tolerance, and market conditions. Major pairs like EUR/USD, GBP/USD, and USD/JPY are popular among traders due to their liquidity and lower spreads.

Exotic pairs can offer higher volatility but are riskier. Choose a pair that aligns with your trading goals and strategies.

What are the safest currency pairs to trade?

Safety in trading often refers to lower volatility and reduced risk.

Major currency pairs, including EUR/USD, USD/JPY, and GBP/USD, are generally considered safer due to their stability and liquidity.

However, no pair is entirely risk-free, and it’s essential to use risk management tools like stop loss orders to protect your capital.

What is the smoothest forex pair?

Smoothness in forex pairs refers to pairs with relatively stable and less volatile price movements.

Major pairs like EUR/USD and USD/JPY are known for their smoother, more predictable trends compared to exotic or minor pairs.