How To Close, Delete Or Deactivate Your QuickCheck Account Easily

QuickCheck is amongst the list of best loan apps in Nigeria that offers quick and convenient access to personal loans. This loan app offers an efficient and user-friendly platform for individuals who need immediate financial assistance with flexible and competitve interest rate. It doesn’t matter whether you’re facing unexpected expenses or need extra cash to cover bills, QuickCheck is here to help you out. In this article, I’ll walk you through how to close, delete or deactivate your quickcheck account easily if you’re no longer interested in borrowing money again. Before looking into how to close, delete or deactivate your quickcheck account easily, let’s see how QuickCheck loan app works.

How Quickcheck loan app works

Read: How to Close, Delete or Deactivate your Piggyvest Account Easily

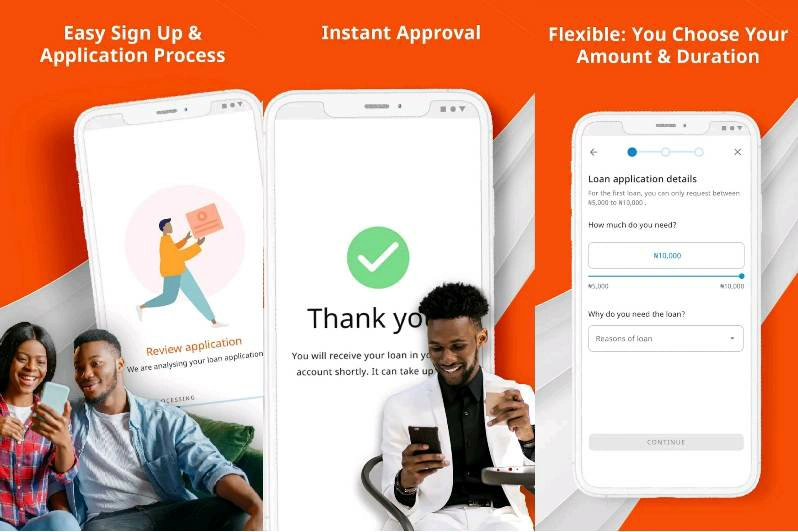

QuickCheck loan app works by providing a simple and streamlined process for individuals to apply for and receive personal loans.

Here’s a step-by-step overview of how Quickcheck loan app works:

Download and Install

Start by downloading the QuickCheck loan app from the respective app store on your smartphone.

Install the app and create an account by providing the necessary information.

Registration and Profile Setup

How To Close, Delete Or Deactivate Your QuickCheck Account EasilyComplete the registration process by entering your personal details, such as your name, email address, phone number, and sometimes additional information like your employment status or monthly income.

This information helps QuickCheck assess your eligibility for a loan.

Loan Application

Once your profile is set up, you can proceed to apply for a loan.

The app will ask you to provide additional information, such as your employment details, bank account information, and sometimes your social media profiles.

This information helps QuickCheck evaluate your creditworthiness and determine the loan amount you qualify for.

Loan Evaluation

LQuickCheck uses advanced algorithms and data analysis to assess your loan application.

They consider factors like your credit history, income level, and other relevant data to determine your loan eligibility and the loan amount you can borrow.

Loan Approval

After evaluating your application, QuickCheck will notify you about the loan approval decision.

Read also: How to Close, Delete or Deactivate your Fairmoney Account Easily

If approved, you will receive details regarding the loan amount, interest rate, repayment duration, and any associated fees.

Loan Disbursement

If you accept the loan offer, QuickCheck will disburse the loan amount directly into your bank account or through mobile money platforms, depending on the options available in your location.

The disbursement process is typically fast, allowing you to access the funds quickly.

How To Close, Delete Or Deactivate Your QuickCheck Account Easily In 2023

The guidelines on how much to close, delete or deactivate your quickcheck account easily is quite simple. It’s simple if you follow the given guidelines online. To deactivate your quickcheck account, kindly follow the process below:

- Open your Gmail account on your smartphone or computer

- Write/Compose a new email addressed to QuickCheck’s customer care or support team. Here is the quickcheck email address (support@quickcheck.ng).

- In the subject line of the email, write something like “Request to Permanently Deactivate My QuickCheck Loan App Account.”

- In the body of the email, provide the necessary details to help identify your account. This may include your full name, registered email address, and any other relevant information that can assist QuickCheck in locating your account.

- Clearly state your request to deactivate your QuickCheck loan app account. You can mention that you no longer wish to use the app and would like your account to be permanently deactivated.

It’s quite advisable to request confirmation of account deactivation in your email or check by yourself by trying to login to the app with your login credentials, if you’re unable to login, then your account has been deleted successfully.

FAQs On How To Close, Delete Or Deactivate Your QuickCheck Account Easily

Below are some frequently asked questions and answers on how to close, delete or deactivate your quickcheck account easily in 2023:

How much can I borrow from the QuickCheck loan app?

The loan amount you can borrow from QuickCheck depends on various factors, including your creditworthiness, income level, and repayment history.

QuickCheck usually offers loans ranging from lower amounts (N1,500 to higher amounts (N1,000,000, but the specific loan limits may depend based on your individual circumstances and the policies of QuickCheck.

What are the requirements to borrow money from QuickCheck?

Quickcheck also like other loan apps has its own loan requirements for borrowers, below are requirements you must be to be eligible for quickcheck loan:

- Being at least 18 years old or the legal age of adulthood in your country.

- Having a valid identification document (e.g., national ID, driver’s license, or passport).

- Providing proof of income or employment details.

- Having an active bank account or mobile money wallet.

- Meeting the credit criteria set by QuickCheck etc.

What is QuickCheck’s loan interest rate?

The interest rates charged by QuickCheck may vary depending on several factors, such as your creditworthiness, loan amount, repayment duration, and local regulations.

Is the QuickCheck loan app legal?

Yes, QuickCheck loan app operates within the legal framework of the countries in which it operates.

QuickCheck aims to comply with applicable laws and regulations to provide legal and reliable loan services to its customers.

Is the QuickCheck loan app approved by the Central Bank of Nigeria (CBN)?

QuickCheck is an active lending platform in Nigeria and one of the CBN approved financial loan company.