Owealth, fixed, target: opay savings review, interest rates, FAQs and more

Opay, a CBN licensed microfinance bank in Nigeria has seen it’s stock rise to the top, in the recent years, thanks to a plethora of products that have become very popular among the masses of the country.

One of the product that have really catch the eye of users is the opay savings.

According to opay , over a million users are saving and earning interest on different opay savings products monthly.

The screenshot above is from the opay app, that’s the Target savings screen. You can see that a number of people are using opay savings to save.

Types of opay savings account

The main aim of writing this article is to differentiate different opay savings products, and what you’ll get from each.

Opay currently has 5 different savings product and while they may appear to be much, they’re all unique and offers different flavors of savings.

The products are:

- Owealth

- Fixed savings

- Savebox

- Target savings

- Spend and save

we’ll start with Owealth down till the end, you’ll get to know the different opay savings interest rate for all account types.

Owealth savings

Owealth is opay default savings account, with Owealth, you you’re paid interest daily, and for some people that can’t wait till the end of the expiry date to get the interest, this is a good option.

Owealth FAQs:

how much interest do I earn with Owealth?

With owealth, you get 15% Annual interest for savings of N100,000 and below. For savings above N100,000, you’ll get 15% annual interest for the first 100k and 5% interest for the remainder of the savings.

How is Owealth interest paid?

Interest is paid out every morning to your Owealth account

can i withdraw the savings on my Owealth anytime?

you can withdraw the money on your Owealth account at any time without any penalty, and can also use it for bill payments, airtime purchases and more.

how to deposit on Owealth:

- Open your opay wallet application

- on the footer navigation, click on finance

- Click on Owealth

- Click on invest

- Enter the amount you want to invest and confirm

- You’ll receive a “successful transfer to your Owealth account” message.

Who is Owealth for? Owealth is for individuals that want to earn daily interest on their money without any strings attached, with Owealth you get the flexibility of earning interest and also having access to your money anytime you want, without any penalty.

Fixed savings

As the name suggests, opay fixed savings gives you interest on your fixed deposit account, unlike Owealth that interest is paid out daily, fixed savings interest is only paid out when due.

Fixed savings FAQs:

how much interest do I earn with Fixed savings?

for savings balance N300,000 and below you’ll be paid 15-18% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15-18% for the first 300k and 6% interest for the remainder of the money.

How is Opay Fixed savings interest paid?

If you Lock your funds while creating your plan, all the interest will be paid to you immediately and your funds will be locked up for the stipulated time. Note: you can’t withdraw in advance if you want to withdraw.

can i withdraw the savings on my fixed savings anytime?

if you don’t lock your funds, you can withdraw anytime. But only half of the interest already earned for that period will be paid.

Note: opay fixed savings has two modes, locked and unlockd. If you choose to look your savings, you won’t be able to withdraw in advance, no matter the circumstances.

How to deposit on opay fixed savings:

- Open your opay wallet application

- On the footer navigation click on finance

- click on fixed

- Click on create a plan

- Select the duration period, eg 30-60 days, 60-300 days, 300 days to 1000 days.

- Fill in the appropriate details and click next

- You’ll be shown a payment page, which you can use either your opay account, Owealth, card or bank deposit to make the payment.

- If successful, your plan will be created.

Who is opay fixed savings for? Opay fixed savings is for individuals who want to get the maximum interest from their savings, and for people that don’t want to tamper with their cash, for reasons known to them.

Opay Safebox savings

Opay Safebox is a savings account which you can deposit daily, weekly or monthly and earn interest on due date. The catch here is that to withdraw you’ll have to pay a penalty for withdrawing before the due date. This is to promote savings discipline.

Safebox savings FAQs:

how much interest do I earn with safebox ?

for savings balance N300,000 and below you’ll be paid 15% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15% for the first 300k and 6% interest for the remainder of the money.

How is safebox interest paid?

Interest is paid daily to your Owealth account.

can i withdraw the savings on my Owealth anytime?

You can set the withdrawal date or use opay default withdrawal dates, which are march 31st, June 30th, September 30th and December 31st

You can withdraw anytime, but you’ll incur a fee of 1.5% of the savings balance for withdrawing on NON WITHDRAWAL DAY.

Who is safebox savings for? Safebox savings is for individuals who want to keep to a strict savings plan.

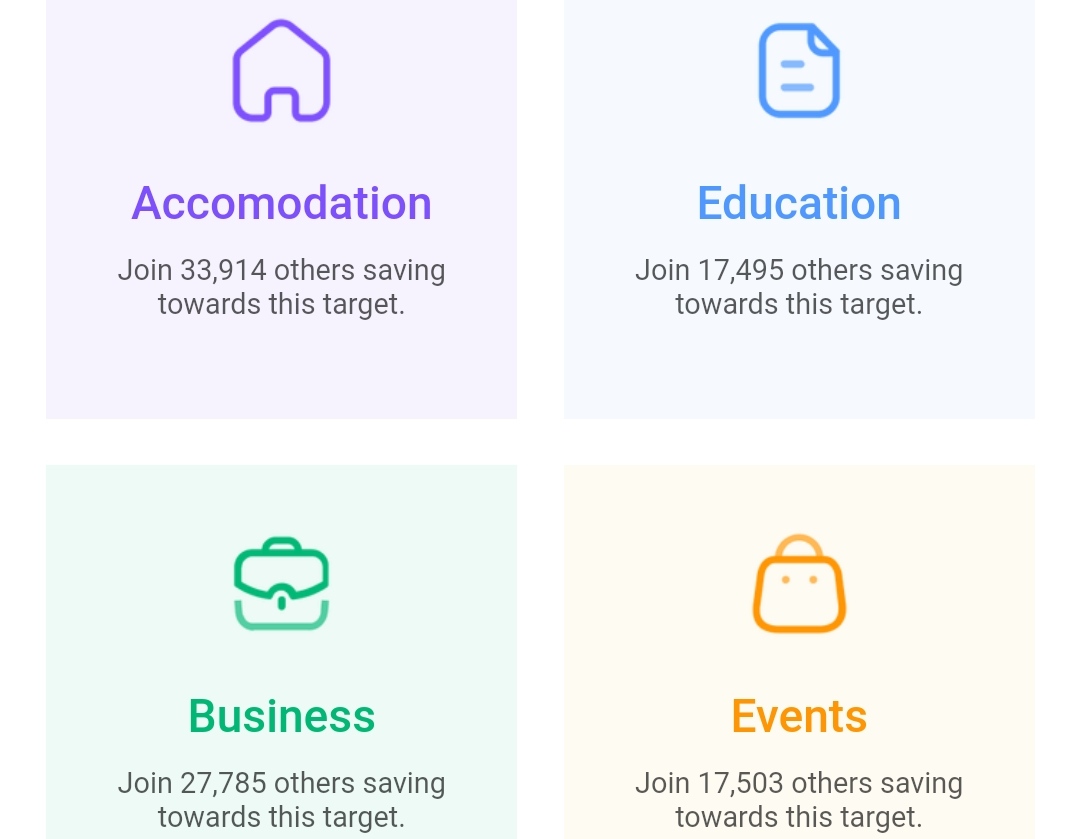

Opay Target savings

Opay target savings, just like the safebox savings account allows you to create a daily, weekly or monthly savings plan. With this you’re saving for a specific target, which can be School fee, accomodations, gadget, and so on.

This savings plan allows you to define the goal you’re saving for strength up, Set a target you want to meet and also set when you’ll want to meet the target.

By so doing, you’ll know how much you’ll be saving daily, weekly or monthly to meet the target.

Target savings FAQs:

how much interest do I earn with target savings?

for savings balance N300,000 and below you’ll be paid 15% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15% for the first 300k and 6% interest for the remainder of the money.

How does target savings function?

You set your target and pay daily, weekly or monthly to reach the target.

How is Target savings interest paid?

interest will be paid on the day of maturity along with your savings.

can i withdraw the savings on my Target savings anytime?

If you decide to withdraw in advance, no interest will be paid, and a liquidation fee of 0.5% of the savings balance will be charged.

Will I be paid interest if I don’t reach the target?

If at maturity, you didn’t reach your target, no interest will be paid.

Who is target savings for? Opay target savings is for individuals who want to save for something very important and want to have a clear strategy to follow in other to reach the target.

Spend and save

opay spend and save is a savings product that encourages users to save a percentage of any amount they spend.

let’s say you set the percentage to 5%, you’ll effectively be saving 5% of any money you spend or withdraw from your opay account.

spend and save FAQs:

- 15% interest paid anually

- Interest is paid out daily

- You can cancel anytime, by setting percentage to 0%

- You can Withdraw spend and save savings anytime, without any penalty.

Who is opay spend and save for? Opay spend and save is for individuals who want to save a fraction anytime they spend, this can be helpful in the long run, as you are not only spending but also saving and getting interest on your savings.

The aim here should not be the interest earned, but what your are able to save .

Note: Complete FAQs on all the savings types can be found on the opay app.

To locate it:

- Open the opay app

- Click on finance (bottom navigation)

- Click on any savings type

- click on MORE (located at the top right corner)

- Click on questions and answers

Conclusion

Now that you’ve got to know about the different opay savings products, I’ll leave it to you to decide which one is best for you. Meanwhile you are not limited in the number of opay savings type you can use at a time, so you can choose to use all, there’s absolutely no problem.