Kuda Bank News Today: What Is Wrong With Kuda Bank Today; Is Kuda Bank Having Issues Today?

Kuda Bank News Today: What Is Wrong With Kuda Bank Today; Is Kuda Bank Having Issues Today

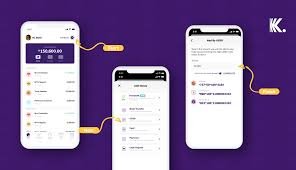

Kuda bank is a Nigerian financial technology (fintech) company which has gained ground since its establishment. But is Kuda bank perfect? In this kuda bank news today, I’ll provide answers to the question (what is wrong with kuda bank today, including “is kuda bank having issues today”?, answers to common frequently asked questions are also provided. Without taking your time, let’s go explore now.

Kuda Bank News Today: What Is Wrong With Kuda Bank Today; Is Kuda Bank Having Issues Today

Everything you need to know about Kuda Bank News today: what is wrong with kuda bank today; Is Kuda Bank having issues today can be found below:

What Is Wrong With Kuda Bank Today?

From my findings, nothing is currently happening to Kuda bank as of the time this article is written.

However, there are common problems users often experience while using the kuda bank app or online portal, these are what we’ll look into in the next step.

Is Kuda Bank Having Issues Today

Also, Kuda bank is not experiencing certain issues today, however, there are technical issues users often experience. Some of them are the following:

Chronic System Failures And Network Issues: Kuda Bank has been known to experience chronic system failures and network issues in the past.

These technical challenges have posed a threat to the bank’s operations and have caused inconvenience to its customers.

Such issues can disrupt the smooth functioning of the bank’s services and affect the overall customer experience.

Temporary Transfer Failures: There have been instances where transfers from Kuda Bank to Wema Bank have failed temporarily.

Therefore in cases like this, the bank has taken steps to reverse all failed transactions.

Read: Moniepoint Agent App: How To Download Moniepoint ATM App For Android And iOS

Itcs quite advisable not to retry the transfer until the issue is resolved to avoid any potential complications.

App Glitches And Customer Account Issues: Kuda Bank has encountered major technical glitches in the past, leading to customers’ money disappearing and transactions becoming impossible.

These incidents have caused concerns among customers who were unable to access their funds.

However, the bank has assured its customers that their money is safe despite the app glitches.

Service disruptions during peak hours: Like any banking institution, Kuda Bank may experience service disruptions during peak hours due to the high volume of customer transactions.

This can result in delays or errors in processing transactions, accessing account information, or using certain features within the app.

Customer Support Challenges: As Kuda Bank grows its customer base, it may face challenges in providing timely and efficient customer support.

Increased customer inquiries and issues could potentially lead to longer response times or delays in resolving customer concerns.

This can be frustrating for customers who rely on prompt assistance.

Security concerns and fraud risks: Banks are always vulnerable to security threats and fraud attempts.

Kuda Bank may face challenges in ensuring the security of its systems and protecting customer accounts from unauthorized access or fraudulent activities.

While the bank implements security measures, there may still be instances where customers face security-related issues.

Limited Services Or Features In Certain Regions: Kuda Bank primarily operates in Nigeria and may have limitations in terms of services or features available in specific regions.

This could be due to regulatory requirements, infrastructure limitations, or other factors that impact the bank’s ability to offer a comprehensive range of services across the entire country.

Payment gateway Integration Issues: Kuda Bank carries out transactions and payments through various payment gateways.

However, there can be occasional integration issues with these third-party providers, resulting in disruptions or delays in processing payments or transfers.

These issues are usually resolved as soon as possible, but they can impact the overall user experience.

Limited Physical Presence: Kuda Bank operates as a almost branchless bank, meaning it does not have physical structures or branches where customers can go to lay complaints or seek assistance in person except a location in Nigeria.

This lack of physical presence can sometimes make it challenging for customers to address their concerns effectively.

FAQs On Kuda Bank News today: what is wrong with kuda bank today; Is Kuda Bank having issues today

Here are some frequently asked questions on Kuda Bank News today: what is wrong with kuda bank today; Is Kuda Bank having issues today with answers:

Is Kuda a registered bank?

Yes, Kuda is a registered bank.

They have a microfinance banking license from the Central Bank of Nigeria.

How is Kuda different from other banks?

Kuda is a fintech app that offers a range of banking services.

Unlike traditional banks, Kuda operates primarily through its mobile app, providing a convenient and user-friendly banking experience.

They focus on digital banking solutions and aim to make banking more accessible to individuals.

How does Kuda bank make money?

Kuda bank generates revenue through various channels.

They often earn income from transaction fees, interest on loans, partnerships with other financial institutions, and other revenue streams.

Does Kuda bank offer loans?

Yes, Kuda bank offers loans to eligible customers.

Can I send money within the UK using Kuda bank?

Yes, Kuda bank allows you to send money within the UK.

Their app provides a convenient way to transfer funds to other Kuda bank users or make payments within the UK.

Can I request a Visa card from Kuda bank?

Yes, you can request a Visa card from Kuda bank.

Their app offers the option to order a Visa card, which can be used for various transactions and payments.

What are the requirements to open a business account with Kuda bank?

To open a business account with Kuda bank, you will need a personal Kuda account on Tier 3, which should be upgraded with your BVN (Bank Verification Number) and a valid ID.

Are there any charges while using Kuda bank’s APIs?

Currently, Kuda bank charges for transfers, such as NIP transfers and transferring funds from Kuda to another bank, when using their APIs.

What services does Kuda bank offer for individuals in Nigeria?

Kuda bank offers a range of services for individuals in Nigeria, including sending and receiving money, making payments, requesting a Visa card, and accessing various banking features through their mobile app.

They aim to provide a seamless and convenient banking experience for their customers.