List of Banks That Charge Zero Transfer Fees

Apart from Opay and VBank, what other Banks charge zero transfer fees?

This article entails a list of some Fintech companies or digital banks that charge zero transfer fees.

There are many of them, while Opay and VBank are commonly known for offering zero transfer fees, there are still some that do the same and that is what you will be exploring in this given analysis.

Those I’m going to show you are not limited to Nigeria but use internationally as well.

List of Banks That charge zero transfer fees Apart from Opay and VBank

Below are the other banks that charge zero transfer fees:

Revolut

Revolut is a UK-based digital bank that offers fee-free currency exchange and money transfers between Revolut accounts.

Revolut also offers a premium subscription service with additional benefits, such as unlimited fee-free currency exchange and faster money transfers.

Chime

Chime is a US-based digital bank that offers zero bank transfer fees between Chime accounts.

It’s a Fintech company that also offers a roundup savings feature and a debit card with cashback rewards for individual users to make money.

Monzo

Monzo is a UK-based digital bank that offers zero transfer fees within the UK and to some international countries. It also offers a premium subscription service with additional benefits, like zero charges on withdrawals abroad and travel insurance.

Carbon

Carbon (formerly known as Paylater) is a Nigerian fintech company that offers loans, payment solutions, and investment opportunities.

Carbon offers low transaction fees and allows users to send money to other Carbon wallet users for free.

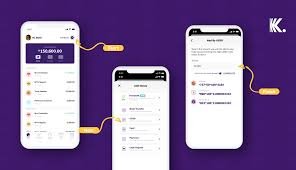

Kuda

Kuda is also one of the banks that charge zero transfer fees.

It is a Nigerian digital bank that offers payment solutions and a mobile wallet. Kuda allows users to send money to other Kuda users for free and also offers low transaction fees for other transactions.

Sparkle

Sparkle is a Nigerian digital bank that offers payment solutions, loans, and investments to its individual users. It remains one of the best Fintech companies and banks that charge zero transfer fees on customers’ transactions.

ALAT

ALAT is a Nigerian digital bank that offers payment solutions and a mobile wallet. ALAT enables its users to carry out transactions; send money to other ALAT users for free, and also offers low transaction fees for other transactions.

What other banks charge N10 as transfer fees like Kuda and Palmpay?

There are some Nigerian fintech companies that charge N10 for transactions.

The following are examples of other banks that charge 10 as transfer fees like Kuda and Palmpay:

Paga

Paga is one of the Nigerian top fintech companies that offers payment solutions and a mobile wallet.

Read Also: Kuda Bank Loan: How To Apply For Loan And Borrow Money From Kuda Bank App

Paga charges a flat fee of N10 for all transactions, regardless of the amount.

OPay

Related: Opay Products And Services, Fees, Registration Process, Customer Support, Investment

OPay is a Nigerian fintech company that offers payment solutions, loans, and investments. OPay charges a flat fee of N10 for all transactions, regardless of the amount.

Although there’s a probability that the flat rate may increase.

Eyowo

Eyowo is a Nigerian fintech company that offers payment solutions and a mobile wallet. This computer like those mentioned earlier charges a flat rate of N10 on all transactions.

Related: How To Make Money On Eyowo

Kudi Money

Kudi Money is a Nigerian fintech company that offers payment solutions and a mobile wallet. Kudi Money charges a flat fee of N10 for all transactions, regardless of the amount.

Rubies Bank

Another Fintech company in Nigeria that charges N10 as transfer fees like Kuda and Palmpay is Rubies Bank.

Rubies Bank is a Nigerian digital bank that offers payment solutions, loans, and investments. Rubies Bank charges a flat fee of N10 for all transactions, not minding the amount of money withdrawn.

Wallets Africa

Wallets Africa is a Nigerian fintech company that offers payment solutions and a mobile wallet. Wallets Africa charges a flat fee of N10 for all transactions.

Note: The fees and charges offered by these Fintech companies may be subject to change at any time, so it’s always a good idea to ensure you check their terms and conditions before using their services.

Also, some companies may charge additional fees for certain types of transactions or services, so it’s important to be aware of these charges as well.

Frequently asked questions About Banks charging zero transfer fees

Below are the frequently asked questions related to apart from Opay and Vbank, what other banks charge zero transfer fees:

Which bank does free transfer in Nigeria?

Some of the Fintech companies that offer free transfers in Nigeria include Flutterwave, Carbon, Kuda, Eyowo, and Palmpay.

Does Alat offer free transfer?

Yes, Alat offers free transfers to other Alat accounts. However, there may be fees for transfers to other banks or for other services.

What is the best fintech company in Nigeria today?

The best Fintech companies in Nigeria depend on what you’re looking for in a financial services provider. Some popular options include Flutterwave, Paystack, Carbon, Kuda, and Alat.

Which Fintech company is approved by CBN?

The Central Bank of Nigeria (CBN) has approved several Fintech companies to operate in Nigeria, including Paystack, Flutterwave, Interswitch, and Paga, among others including those that were mentioned in this article.

These companies are regulated by the CBN to ensure that they meet the necessary standards for financial services providers.